Build a consolidated view of all your assets (multi-currency and multi-location) in a single FIRE wealth management tool for FREE, and estimate your monthly Safe Withdrawal amounts based on CAPE ratio.

Prenote: Privacy Vs Convenience

As the saying goes, “If you don’t pay for the service, you are the product”. Many online websites who are providing free services are usually selling your data, or using your data to sell you products and services. Moreover, there are always risks of hack or fraudulent activity where your data can be exposed publicly. So, we don’t feel confident that any company can have visibility on our finances.

Too often, we trade our privacy and our data in exchange of convenience. We do it every day, almost every time we subscribe to a website. We give our consent because we don’t have the choice and sharing only a few pieces of information is acceptable. However, letting a company know what the status of our finances are, bank account number, expense habits… is a definitive NO for us. So if you are like us, you should own your data and use your own tools.

FireCracker’s Journey Wealth management tool

In order to control our data, and also because we couldn’t find any wealth management tool capable to aggregate assets in different countries and different currencies, we decided to build our own tool with GoogleSheet. We upgraded the tool along the years we have been using it.

We hope that you will enjoy our Free FireCrackers’Journey Wealth management Tool. You need to copy/save the sheet so that you can update it and make it your own.

Click the GoogleSheet link >> Portfolio & SWR – FireCrackersJourney.com <<

FCJ Wealth dashboard

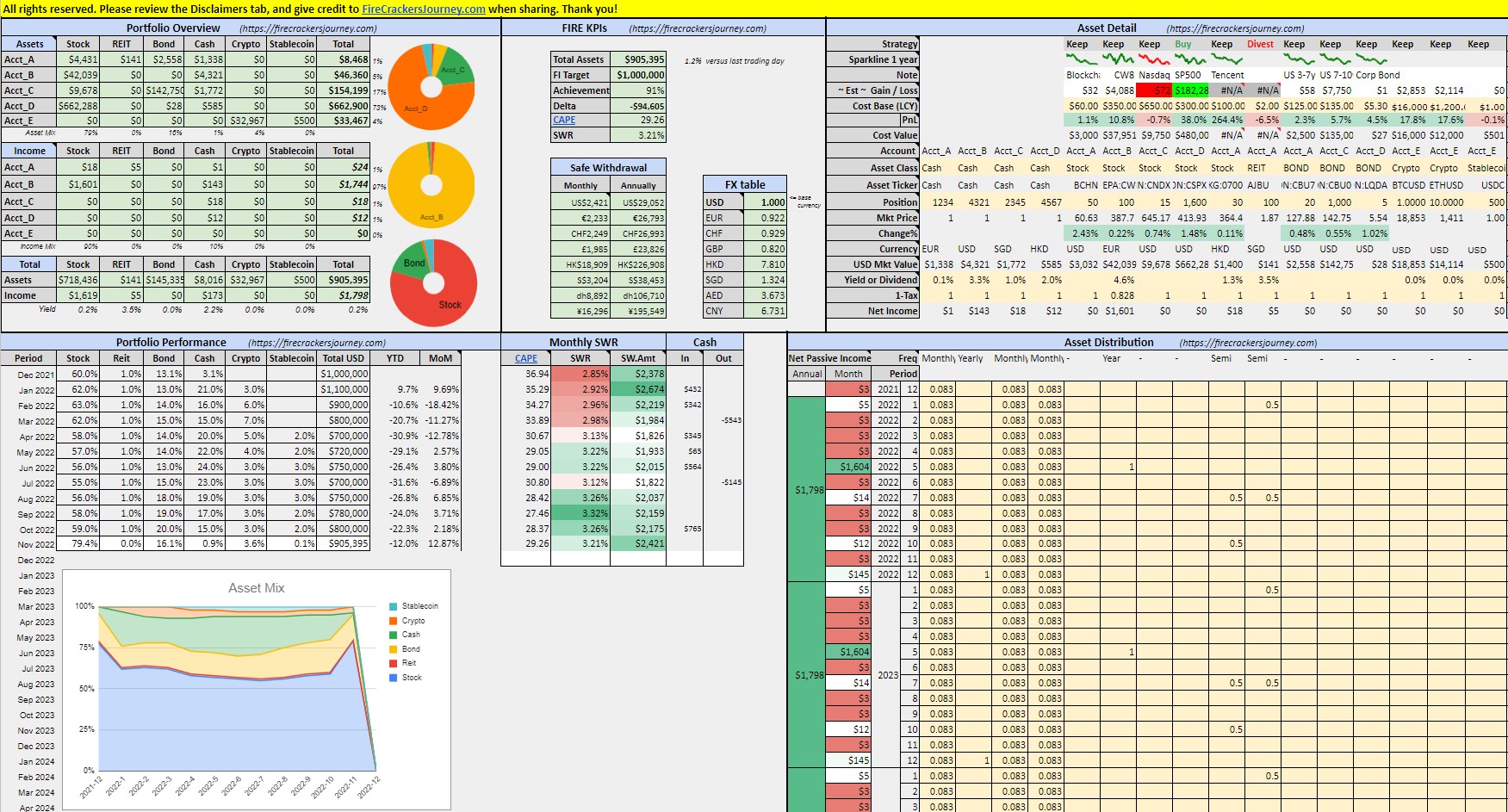

The dashboard contains several areas. Each has a specific objective, and we will explain each to you.

Portfolio overview

Portfolio Overview gives you a snapshot of your assets. There are several tables to help you visualize your assets’ value by account and/or by asset class. I also included a table which adds your income from each of your accounts and assets. Finally, there is a total recap of assets value, income and yield. To illustrate the values in the tables, there are a couple of pie charts on the side. Thus, you can view your assets by account, your income by account, and finally your assets by asset class. These should be enough to have a quick overview of your portfolio with key financial indicators.

Editing note: You can change the name of your accounts for clarity. All the data are automatically calculated based on your Asset Details.

FIRE KPIs

FIRE KPIs

This table recaps your key FIRE values. The Total Assets value is your portfolio value. Below the FI target corresponds to your FI number that you need to reach. The achievement percentage below indicates you how far you are from your FI number goal, and the delta the amount you need to add. The CAPE ratio stands for Cyclically-Adjusted Price-to-Earnings Ratio. Finally, the SWR is the Safe Withdrawal rate suggested by ERN and his formula SWR = 1.5% + 0.5/CAPE.

Editing note: All values are automatically updated except FI target and CAPE which needs your manual input.

Safe Withdrawals

This table offers an estimate of your Safe Withdrawal amount. As we mentioned in the previous post “Check out our FIRE Withdrawal Rate, portfolio and asset mix“, we are not convinced that the “4% rule” (of thumb) is a reliable metric to estimate our withdrawal amount irrespective of market condition. Indeed, we prefer to put our wealth in perspective of the Shiller CAPE ratio. Using the fantastic analysis ran by big ERN on safe withdrawal rate series, and applying the ERN formula (SWR = 1.5% + 0.5/CAPE), we can estimate the Safe Withdrawal amount. We put a monthly and yearly values next to the currency table. Indeed, we found useful to have the withdrawal amounts displays in several currencies, as we are always considering moving to different countries.

Base currency

We move places every couple of years, and we have various multi-currency expenses, assets and income. It is then critical to consolidate all numbers into one base currency. With currencies fluctuating daily, some more than others, it is important to have an instant market view of all our assets into a single currency.

Although we are not living in the US, we track our assets in USD because most of our assets are denominated in USD. It is also a stable currency. Furthermore, we are used to benchmark prices in USD. If most of our assets were in EUR and we would be living in Europe, we would choose EUR as our base currency.

Keep in mind that the base currency is just a tool to aggregate the value of all assets under a single unit of measure. It doesn’t change the intrinsic value of each of the assets of your portfolio.

Editing note: you can change the base currency on the first currency of the list.

Multi-currencies in FX table

The currency table pulls the exchange rate from GoogleFinance. The first currency (currently USD) is the base currency. All your assets will be priced back to the base currency. If you are living in Europe, you might prefer to input EUR as your base currency.

Editing note: You can add or remove any currency to your needs. When you change the base currency, please make sure that the currency only appears once in the table, and that all the currencies of your assets are listed in this table.

Asset details

Multiple asset location

In the future, people will increasingly own assets in different locations and different currencies. With location of financial assets, comes regulation. And regulators in one country might not agree that companies share financial information about their residents. One exception is the CRS to avoid tax evasion. If you are curious, you can check out the OECD website and found out how your Government knows where are all your assets worldwide.

Let’s return to our sheeps. Thus, it is unlikely that you will find a company which can do aggregate these information for you. So, you will have to do it yourself either manually or automatically. As I am lazy to perform low value repetitive tasks, I enjoy building a tool that automates them for me.

In our FCJ Wealth management tool, we can list assets from different exchanges, different banks and accounts, and different currencies.

In the Asset Details area, assets are listed by column. The advantage of structuring the data that way will enable you to estimate passive income from investments (interest, dividend, coupons) over time. All the details about each asset are self explanatory, and you need to populate these information.

Listed vs non Listed assets

Some of your assets are not necessarily listed nor tradable on an exchange. Nevertheless, it is important to consolidate its value with the rest of your assets. If you own a home, you could add the equity value (house value – outstanding loan debt).

I wouldn’t consider adding a car, a boat, or a piece of art, unless it represents a significant amount of your portfolio, and/or the asset has a potential for appreciation.

Editing note: Simply change the “Asset Ticker”, or duplicate an existing column if needed. GoogleFinance will automatically update the current price and the percentage change since last closure. By default, the FCJ tool tracks US exchange, London Stock Exchange (add “LON:” before the asset ticker), Euronext Stock Exchange (add “EPA:” before the ticker), Hong Kong Stock Exchange (add “HKG:” before the ticker) and even also some cryptocurrencies prices! Please keep in mind, that all data are delayed by at least 20 min.

Asset Distribution

This part is optional unless you are interested to forecast your passive income and cash flow. Your portfolio should include some assets distributing a yield at specific interval of time. These cash inflows constitute strings of various income at different period of time. As all listed companies publish their projected stock/ETF dividends and bonds coupons, and their planned settlement date, you could gather these information to simulate your specific portfolio income. Our FCJ Wealth tool does exactly that, you just need to key-in the yield and when the payment will hit your account.

Editing note: In the ‘Asset Detail’ area, you can insert the Yield of your investment (interest, dividend or coupon) in line 18. Then below, the large ‘Asset Distribution’ table below represents the distribution pattern of your asset. If it is an annual payment, put a 1 in the month of distribution. If it is quarterly, insert 0.25 (=1/4) at each month of distribution. And if it is monthly, just key in 0.083 (=1/12). All these values will aggregate back into the “Net Passive income Month” column. Again, past performance is not an indicator of future performance. However, you can still put the yield estimate provided by financial institutions as a gauge.

Net investment income

Now that you have an estimate of your investment income, you can deduct what amount of asset you need to sell to finance your lifestyle. Some people will feel more comfortable with a high yield and not having to sell assets. This approach has its benefits from a psychological point of view.

However, from a tax point of view, dividend income are generally less effective than capital gains. Indeed, you don’t choose when you receive your dividend, whereas you can decide when to sell assets. Moreover, you can offset capital gains with capital loss to reduce the tax impact. This is something that you can’t engineer with dividend income. Although, we initiated our portfolio to generate strings of passive income, we progressively shifted our portfolio constituents to accumulating assets and remove almost all dividend income.

Editing note: I created line 19 as a withholding tax percentage in order to compute an estimated net passive income. If you have no tax on this income, just leave 1. If you have 15% tax in your country, you should insert 0.75 (=1 – 15%).

Portfolio performance

The table on the left tracks the performance of your portfolio overtime. In this table, there are the total asset value in base currency, and the percentage allocated to each asset class. On the right, there is the YTD (Year To Date), or the performance since January 1st. Technically, it uses the last asset value of the previous year. Then, there is the MTM (Month To Month), or the performance from last month. In order to measure a portfolio performance YTD and MTM, we decided to exclude cash movements. Indeed, an increase in cash shouldn’t be accounted as a good performance, although we take the cash value into account in the total portfolio value.

Tracking asset allocation & rebalancing

Below there is a chart which tracks the evolution of the asset class since the beginning of the year. You will notice that it slightly varies during the year, mainly because of market fluctuations. I know that some people rebalance their portfolio with their target portfolio mix. It can be a static allocation 60% Stock and 40% Bonds. Alternatively, it can also follow a glidepath allocation, where stock allocation increases from a 60% or 80% at the beginning of your retirement till a 100% allocation over 10 or 20 years. Big ERN ran some analysis, and you can read the results directly from his blog here. The way we conduct our rebalancing is by selling the asset class and using the proceeds to finance our quarterly spending. Also, as we are aiming for a stock glidepath, we tend to tap more into the REIT and Bond assets.

Monthly SWR

On the right side in the Monthly SWR table, there are some key figures that are interesting to keep on a monthly basis. First is the CAPE ratio, which in turn impact the Safe Withdrawal Rate, and finally the Withdrawal amount. Although your portfolio fluctuates significantly, you will notice that the Withdrawal amount is more stable. It is indeed the impact of the CAPE / SWR which smoothen the values. As mentioned in a previous post, a total portfolio value is meaningful for a retiree when the CAPE ratio is taken into consideration.

Cash Table

To the right, there is a Cash table which tracks the extra cash in or out. We use it to put any money not coming from our investment. For the Cash in, it would be use for income, inheritance, social benefits, severance package… For the Cash out, it would represent a significant expense as the purchase of a car or a home.

Editing note: On the last trading day of every month, you should:

a) update your cash position and illiquid asset value in your accounts,

>> the other assets are automatically updated, and aggregated into the Portfolio value,

b) update the CAPE ratio value,

>> the SWR, and withdrawal amount are automatically calculated,

c) copy the current month values (B34:N34 if it is the last trading day of October 2022) and paste it on the new coming month below (B35:N35 for November 2022),

>> the formulas are now copied and a new month of tracking can start,

d) copy the values of the current month (B34:N34), and paste > special > values on the same cells,

>> the values of the month are now static, and correspond to the last trading day of the month.

I hope that you will find the tool useful to you. You can adapt the tool to your needs in terms of currencies, base currency, tax. The objective is to give you a quick overview of where you are in your FIRE journey. If you enjoy it, please put a comment below and/or consider supporting us by giving some cryptocurrencies. Remember that you can improve only what you are measuring. Happy wealth building and Fire Cracking Journey!

One thought on “Best free FIRE wealth management tool”