Taxes can significantly impact your financial performance. Delaying taxes or strategically offsetting them with capital losses can greatly enhance your investment returns.

Interests vs. Capital Gain Taxes

Taxation on investment income varies from one country to another. Some nations tax interest income but not capital gains, while others have the opposite approach. A few countries don’t tax either. In most cases, both interest and capital gains are subject to taxation, but the nature of this income can affect how it’s taxed.

For instance, in France, all investment incomes face a flat 30% tax rate. However, what many overlook is that you have the option to be taxed at a lower rate of 17.2% (mandatory minimum ‘contributions sociales’) plus the Income Tax Tier. Breaking down the 30%, it can be split as 17.2% + 12.8%. If you fall into the lowest tax tier of 11% (for a maximum income of 27,478 Euros for an individual), it’s financially wise to choose this option. As a member of the FIRE community, minimizing your tax liability should be a priority, and this strategy can help you achieve just that.

In my view, receiving interest or dividends is suboptimal because you’re obligated to pay taxes at a specific time, and you can’t offset this income. On the other hand, capital gains can be offset by capital losses, and you have control over when and how much money you need.

Solutions for a 4.5% yield

There are many financial instrument offering 4.5% yield. I would focus on AAA security like the cash in you bank account and US Treasuries. At the time of writing this post, the current 10-year US Treasury offers a yield of 4.5%. You can track the evolution on Bloomberg.

The 4.5% savings account

Suppose you invest in a savings account offering a 4.5% yield. In this case, you’ll pay taxes on the 4.5% you earn, which is due yearly when you file your taxes or collected at the source by your financial institution.

4.5% yield on Government Treasury

Without delving into intricate details, it might seem that the tax impact would be the same as the savings account. However, the tax implications are entirely different. Due to market efficiency, the yield on Government Bonds are roughly similar for the same maturity. As bonds were issued at various times in the past, with different coupon rates, their prices are different for a similar price.

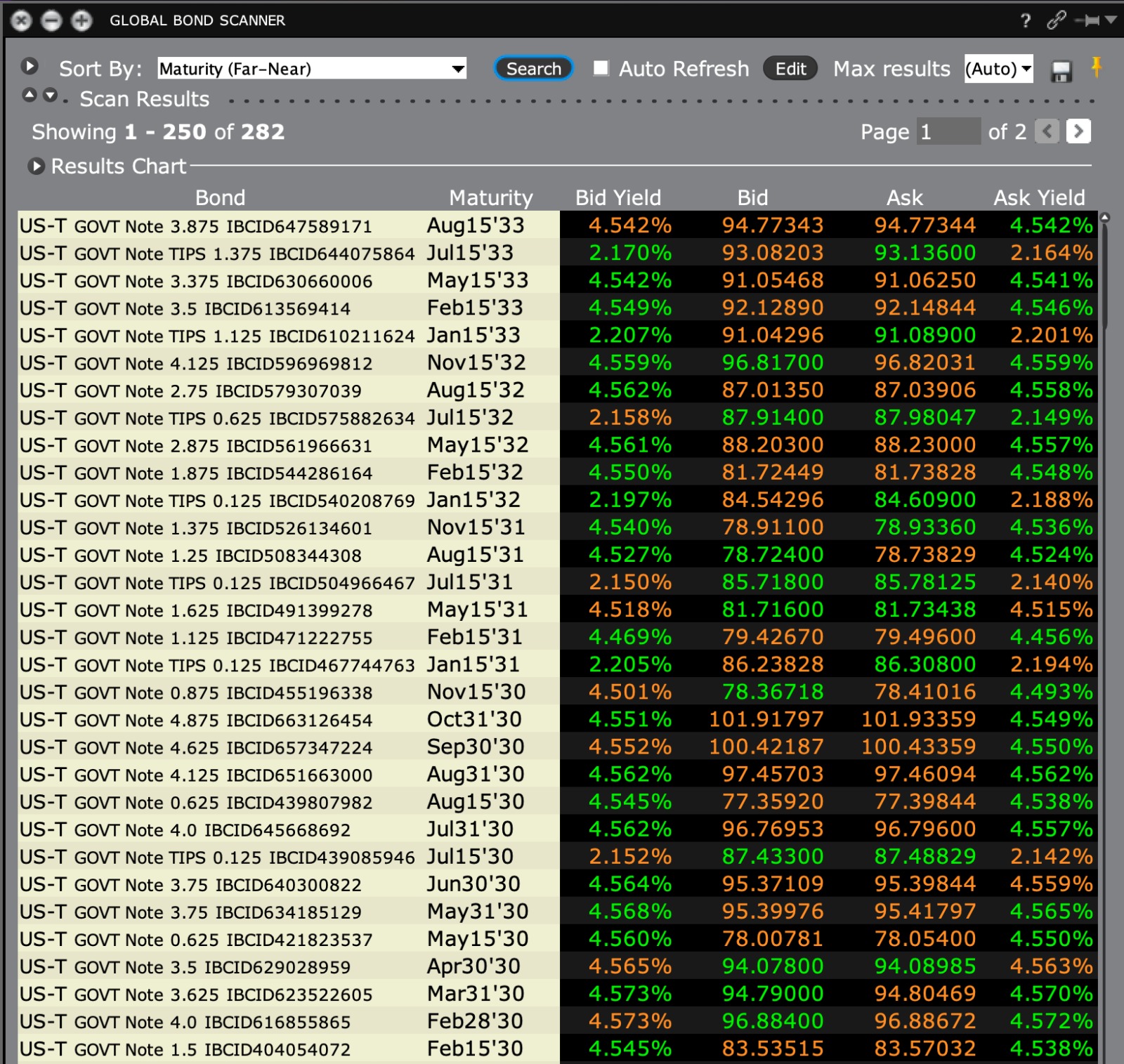

Below is a screenshot of Interactive Brokers (Bond scanner feature) showing several US Treasury maturing in about 10 years (between February 2030 and August 2033). The coupon rates offered, which are fixed, range from 0.625% to 4.875%. On the right side of the Global Bond Scanner window, there are several columns: bid yield, Bid price, Ask Price, Ask Yield for each security. The spread is very narrow, and all these securities have a very similar yield around 4.5% (excluding TIPS).

What are the taxes implications?

For simplicity, I exclude the potential tax advantages of holding Government Treasury and Long Term capital gains, which are subject to your country of residence (and taxation).

If you buy the lowest coupon Treasury of the list (eg US-T Govt Note 0.625 maturing Aug 2030), you will pay $77.39 in order to receive 0.625% coupons and a capital of $100 at maturity (August 2030). Its yield will be 4.54%. Assuming it is treated as a normal bond, you will pay income tax on 0.625% and capital gain tax on $22.61.

On the other side, if you buy the highest coupon Treasury of the list (eg US-T Govt Note 4.875 maturing Oct 2030), you will pay $101.93 in order to receive 4.875% coupons and a capital of $100 at maturity (October 2030). The yield will be the same 4.54%. However, you will pay income tax on 4.875% and accrue a capital loss of $1.93. From a tax point of view, this Treasury would have the same tax implications as putting money in a savings account (assuming you can find a bank offering a fixed 4.5% interest during the next 7 years).

The lowest and highest coupons will mature in 2030 or 7 years from now. Nevertheless, if you look through the list, you may find similar low and high coupons (1.875 and 4.125 coupons respectively) with a 2032 maturity. They will also deliver a 4.54% for the next 9 years.

What happen if rates go down?

In a traditional savings account, your yield will go down as well.

However, if you hold US Treasury till maturity, your yield will remain the same over the next decade! I would like to insist on the maturity factor. Uncle Sam made a promise to repay you the face value of the bond AT maturity. However, the market will decide the value of the asset BEFORE maturity. In order to capture the full yield, you must hold the security till maturity.

Moreover, if you chose the right Treasury, you might even pay less than half the taxes that you would have paid for an alternative one.

What is the best solution?

Beyond the usual disclamer that my point of view is no financial recommandation, and that you should do your own research and/or hire a financial advisor, it is important to understand that there are no best solution. It will depend on your tax residency and investment goals.

As yields are the same, and a current French Tax payer, I would prefer holding the 0.625% coupon Treasury because it will minimize my income taxes and delay the capital gain tax in the future. Also, as I have some capital losses, I will be able to offset the potential capital gains with capital loss, erasing most of the taxes. So, assuming you have some capital loss in the same amount of the capital gains, you could manage to only pay income taxes on 0.625% while earning a 4.5% yield over 10-years!

If you prefer securing a 4.87% interest paid yearly, you may choose the 4.875% coupon Treasury. However it will be at a cost of higher tax bill over the next 7 years.

Understanding the tax implications of your investment choices can significantly impact your financial performance. By strategically managing your taxes and considering the nature of your investment income, you can boost your returns and work towards financial independence.

As each solution is contingent to your tax residency, please share your best investment solution to minimize your taxes either during your accumulation or distribution phase. Looking forward to learning from you!