Taxes can significantly impact your financial performance. Delaying taxes or strategically offsetting them with capital losses can greatly enhance your investment returns.

Like this:

Like Loading...

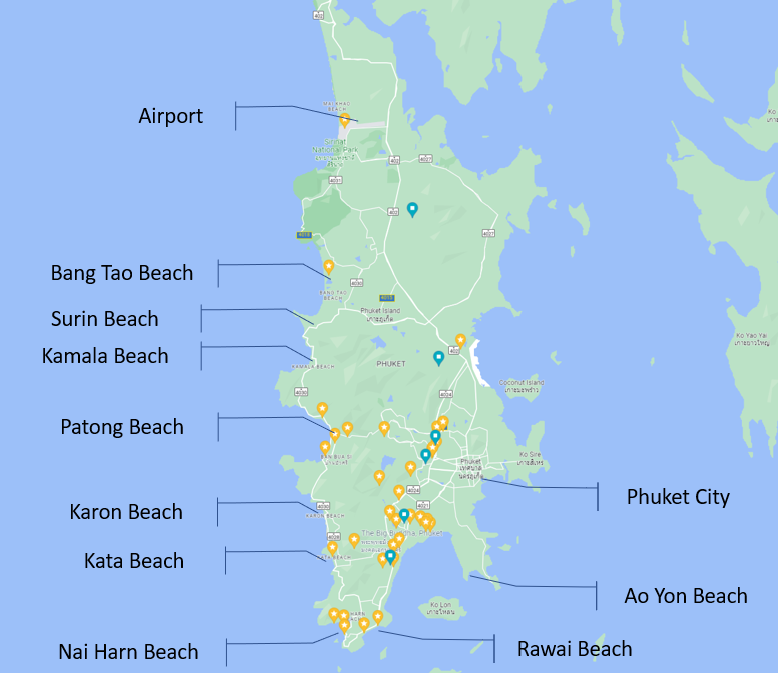

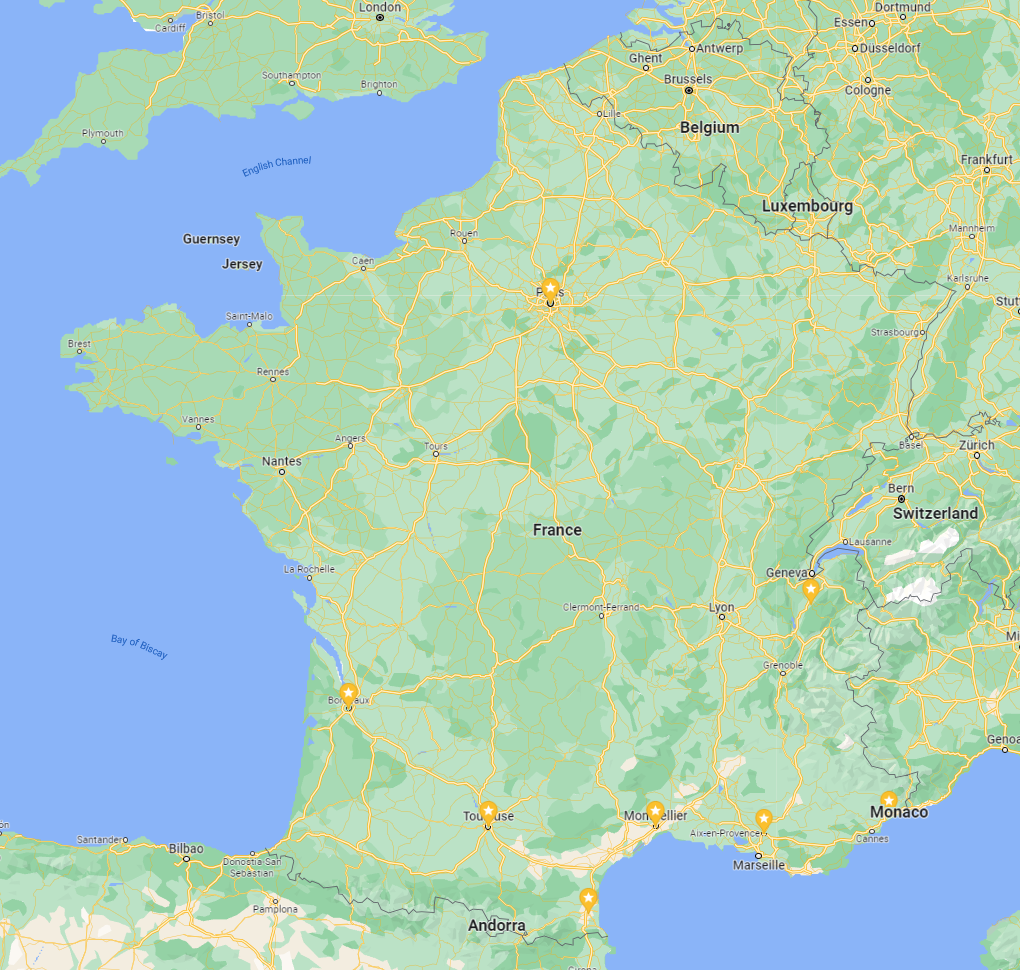

In the process of planning a relocation, it’s essential to understand that it takes time and flexibility. We recently moved back to France after a year-long experience in Dubai, and even though we had previously moved to France from Hong Kong a few years ago, we encountered several challenges. Our experience taught us that preparing for the move out is just as important as settling in the new place.

Like this:

Like Loading...

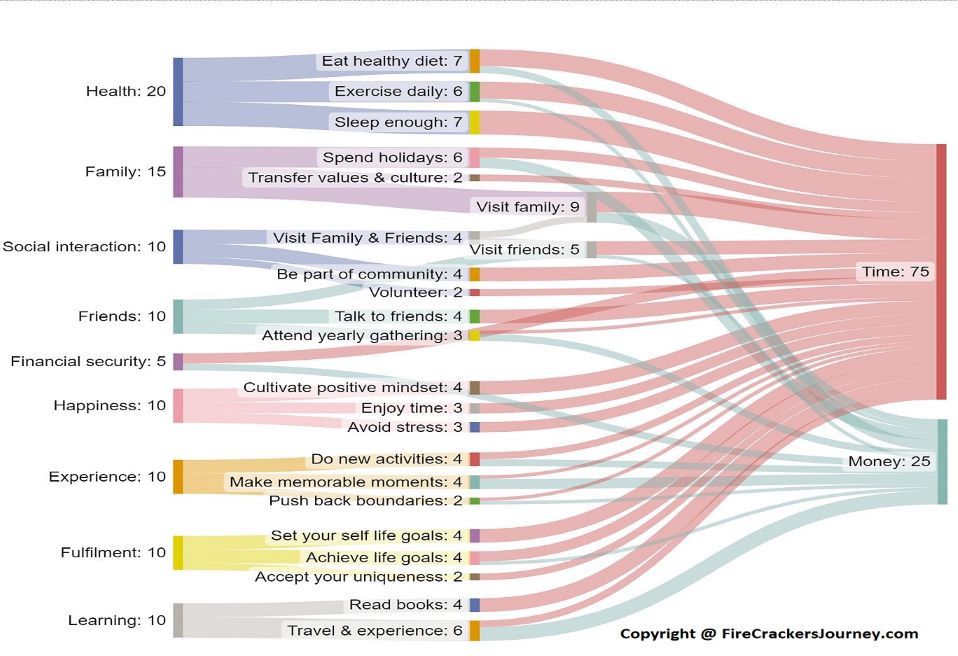

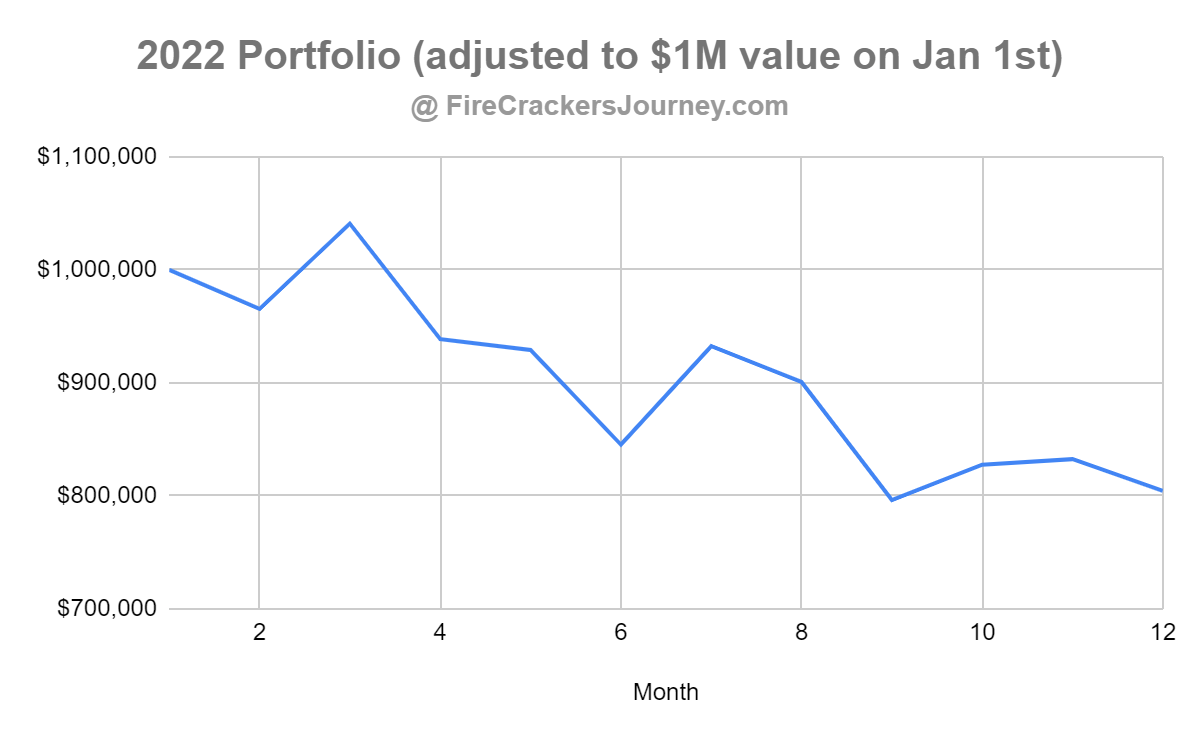

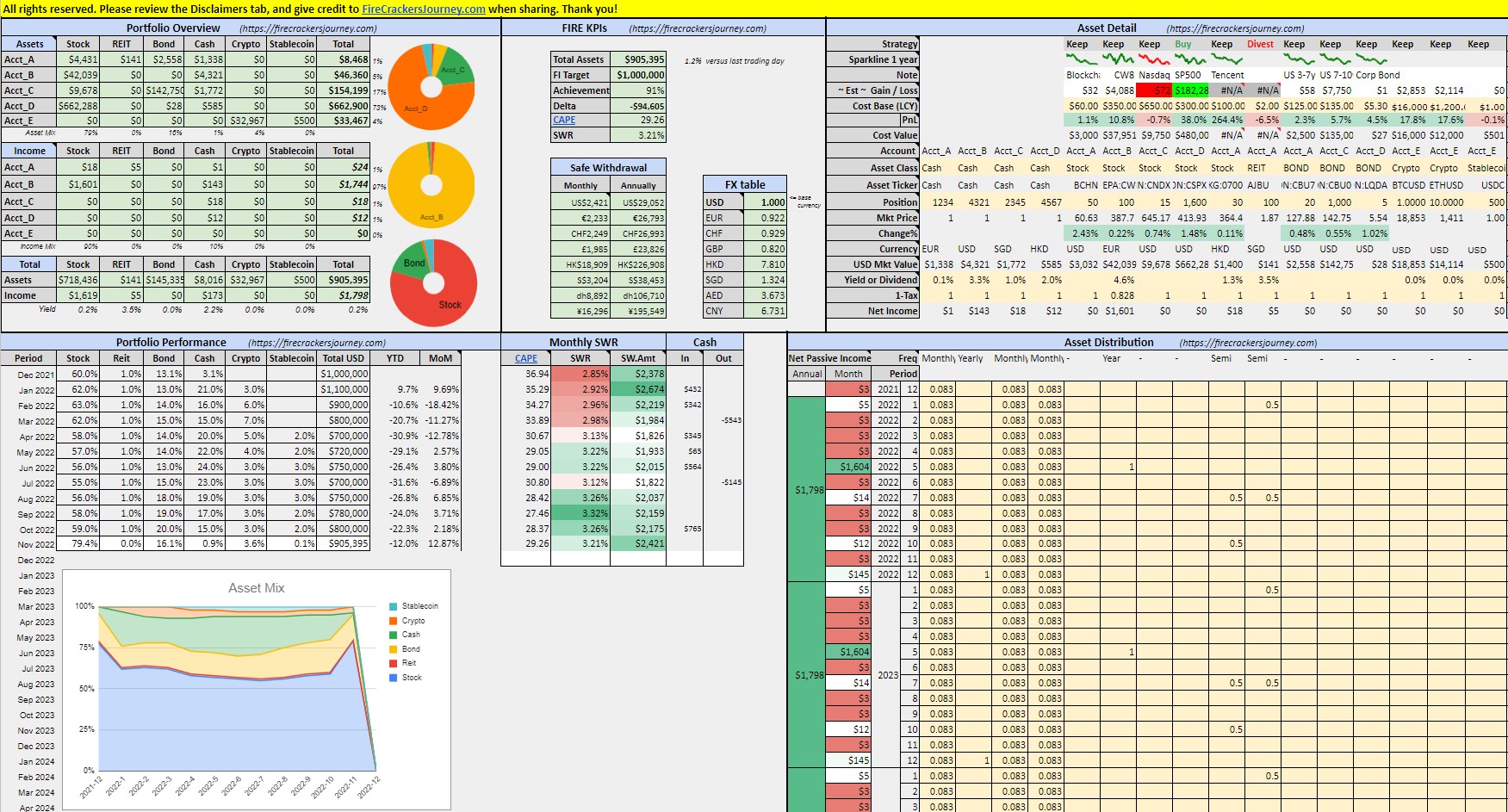

During the last couple of year, we rat raced in Hong Kong, then fired in France and moved to Dubai. All the events have been life changing experiences, and revealing about life. I have broken down the constituents which contribute to a happy and fulfilled life, and assessed what was needed to reach these key elements. We undeniably need some money, but we mostly need time. Thanks to a well structured portfolio and extended planning, the financial part is mainly on auto-pilot, leaving us all the time to live a happy and fulfilled life.

Like this:

Like Loading...

Finding a place to live in France can be a difficult task to say the least. Having been through the process several times, it is important that you are ready to call and visit the place as soon as it gets published. Try to be the first to visit and have your dossier ready with your check book.

Like this:

Like Loading...

Choosing to FIRE is the easy part. Living a FIRE life is more challenging, especially when most of your friends and family are still living their ‘normal’ life. Although our 3 years break was a God saving from our stressful careers, the rest of our life still needs to be written.

Like this:

Like Loading...

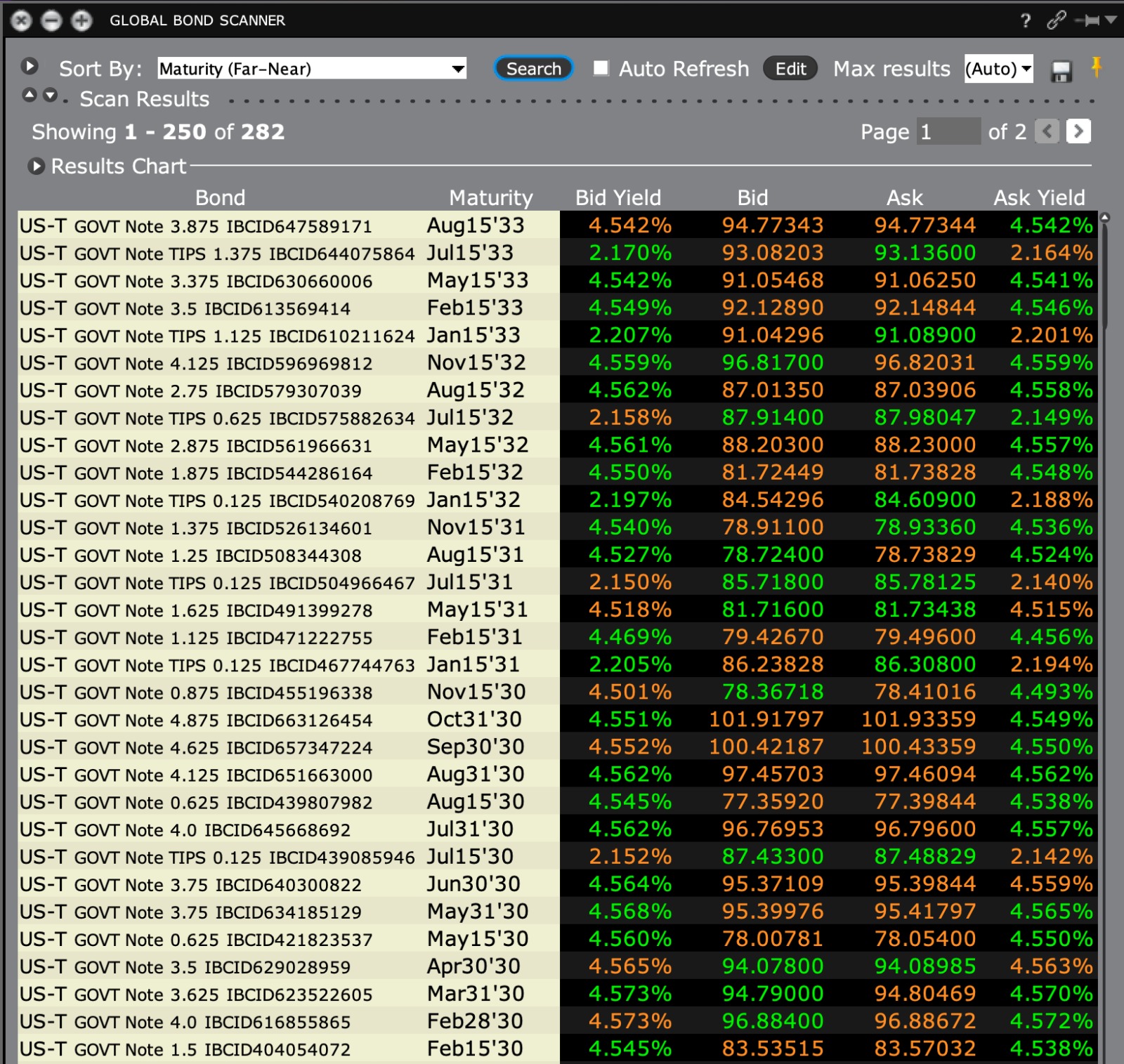

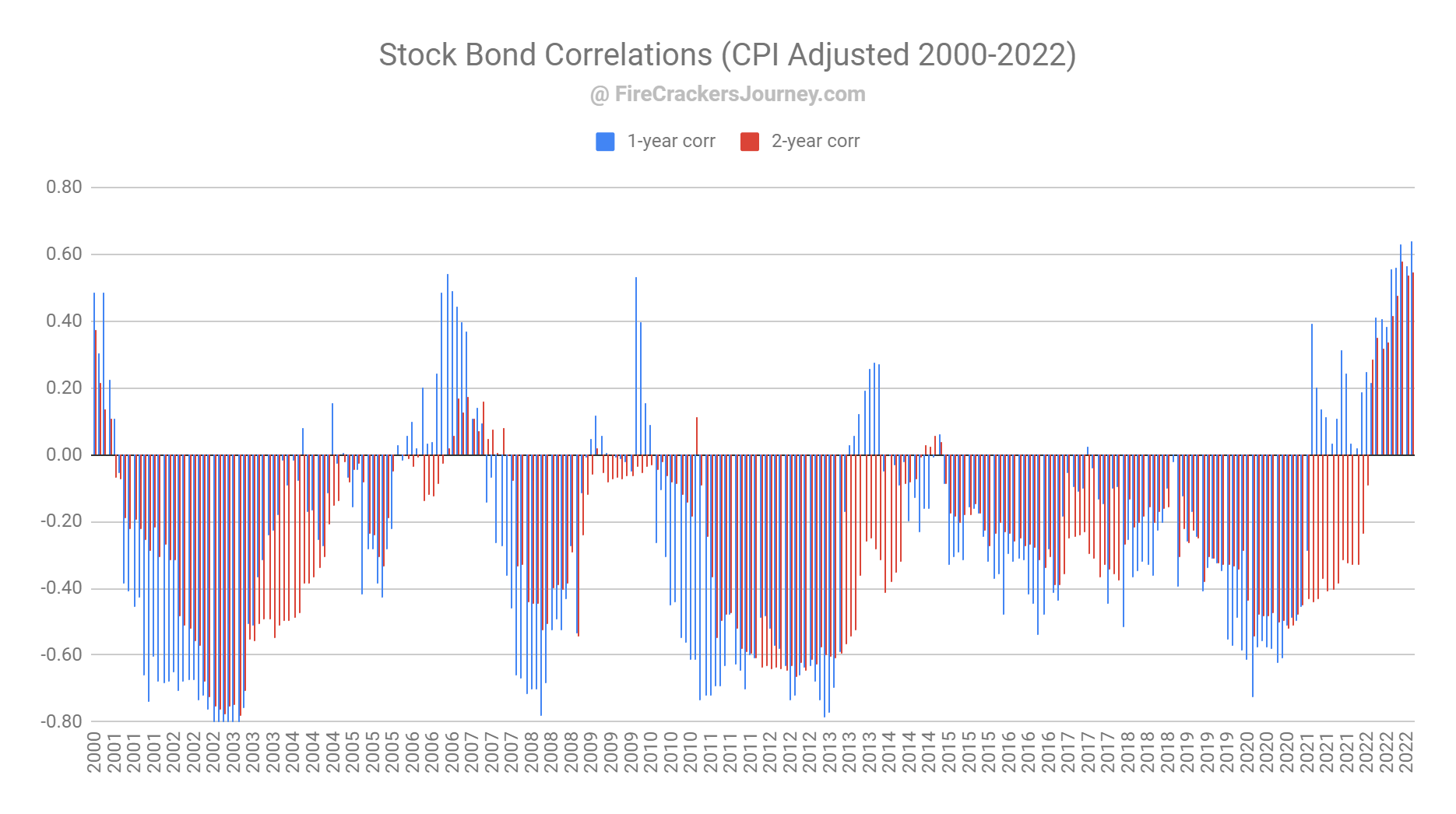

Adding Bonds to a portfolio is supposed to reduce volatility, offer diversification and hedge against a bear market. It used to be true but not anymore. Recently bonds switched from negatively to positively correlated with stocks. What does that mean for your portfolio?

Like this:

Like Loading...

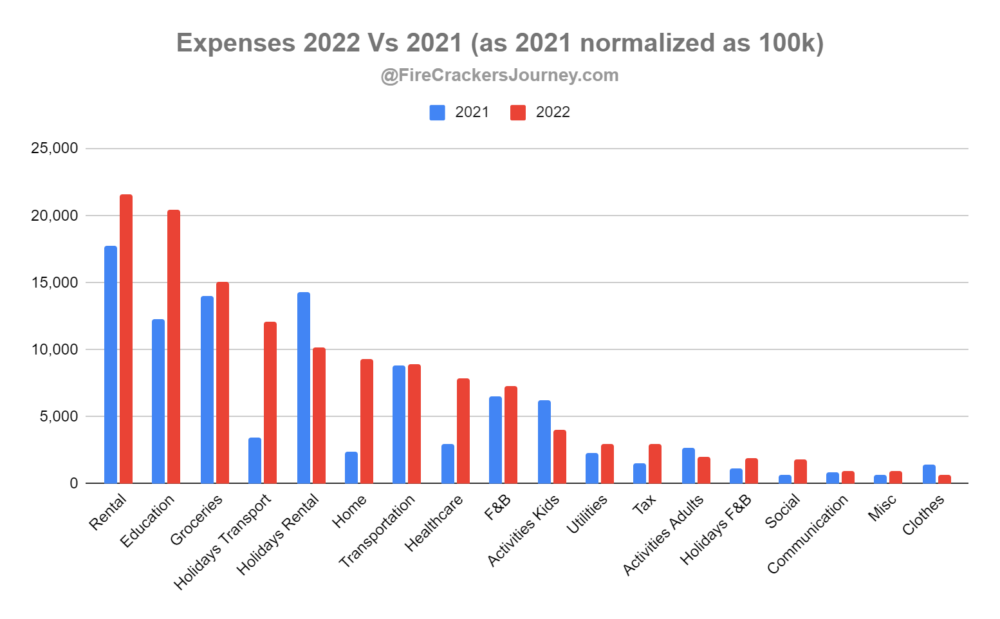

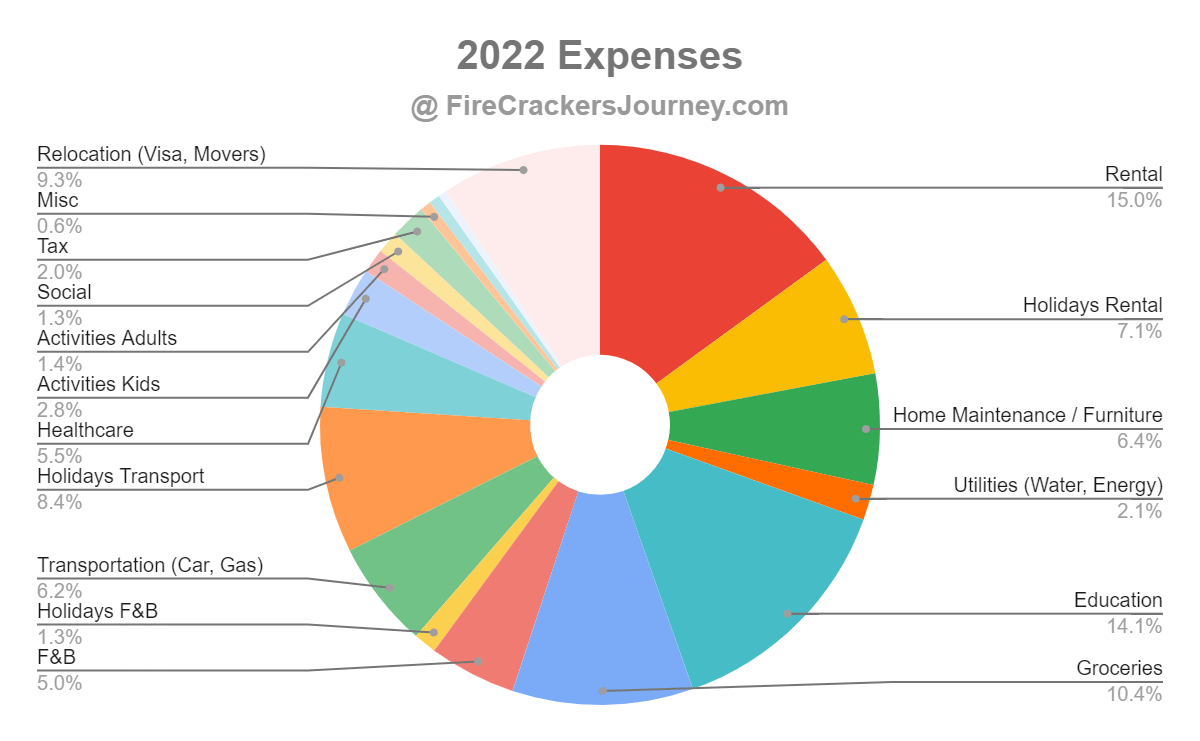

Moving to a new country is expensive. Moreover, inflation combined with a higher cost of living pushed our expenses beyond what we expected. We had to adjust our lifestyle and spending habits to keep our expenses within our budget.

Like this:

Like Loading...

Although we strongly recommend a simple buy and hold strategy of several diversified ETFs in a portfolio, we all made the mistake of individually picking a few stocks. Some have been more successful than others. Likely, you might still hold a couple of loss-making stocks. Understanding when you should sell them is critical to maximize their net value, and reduce your taxes, although they are not worth much.

Like this:

Like Loading...

Spain’s tax system is based on a progressive income tax, with rates ranging from 19% to 47% for personal income tax. Value-added tax (VAT) is a major source of government revenue, with a standard rate of 21%. Other taxes include wealth tax, inheritance tax, and taxes on property and capital gains. The government also collects social security contributions from employees and employers. As early retirees with significant capital and low income, we will delve into tax residency, investment income and wealth tax.

Like this:

Like Loading...

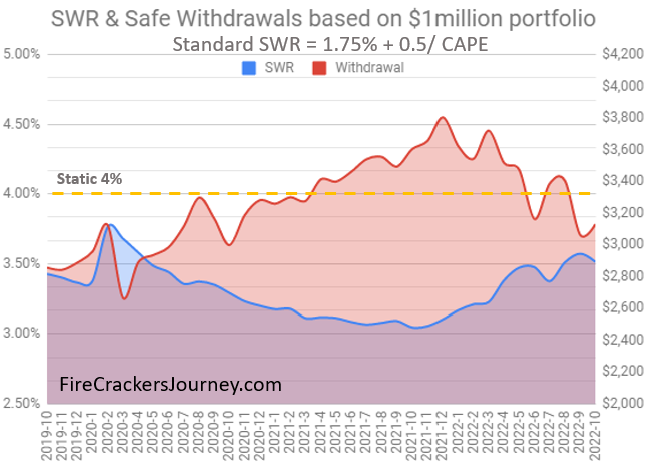

Although we faced inflation and moved to a high cost of living place in 2022, we managed to keep our expenses in check. Dedication to constantly track our expenses and search for best alternative were critical to enjoy the year without tightening our belts. While our withdrawals have naturally increased, they still remain in the safe zone.

Like this:

Like Loading...