Although we faced inflation and moved to a high cost of living place in 2022, we managed to keep our expenses in check. Dedication to constantly track our expenses and search for best alternative were critical to enjoy the year without tightening our belts. While our withdrawals have naturally increased, they still remain in the safe zone.

Welcome back! Now that you have read about our portfolio performance, you might be interested to know how we managed our expenses and withdrawals. Again, 2022 had been full of surprises and learnings. Let’s dive in the numbers!

Free Tools

To track our daily expenses, we have created our own expense tracking tool. I have made it available here for you to download and customize your own version: GoogleSheet Expense Tracking. You can also refer to my post How to get a 5% or 10% increase? for more details.

If you find our tools useful, and would like to support us in our endeavor to share more tools with you, please consider a donation on the left side of the page. Thank you!

2022 Expenses

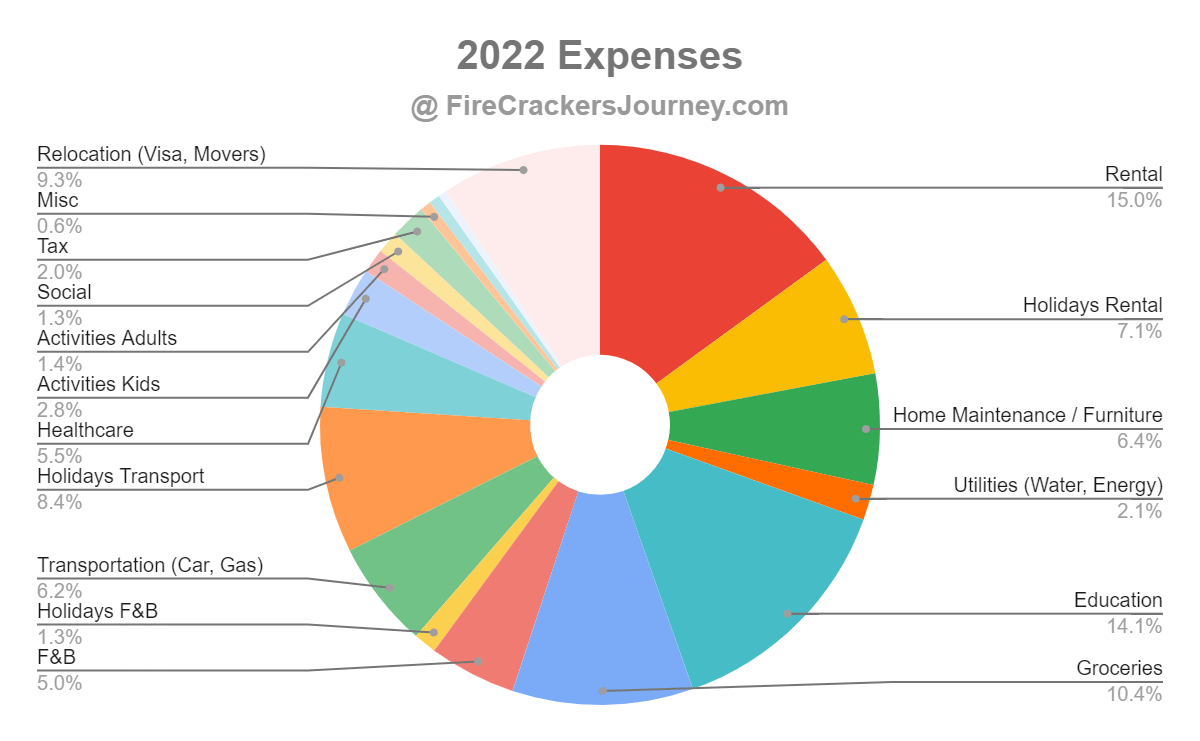

All the expenses’ numbers have been adjusted proportional to an annual total expense of US$100,000. We did it this way so that you can easily scale up or down for comparison. Let’s look at what we found out regarding our spending pattern.

Expense seasonality

As you can see, we were keeping the lids in some months, while exploding the budget in others. February and May were expensive because we went on holidays, a.k.a. exploration trips, during those months. August was the most expensive period as we moved to Dubai and incurred lots of initial setup costs. These include plane tickets for 5, movers and container, residency visa costs, and various items we bought in order to make our home home. The average monthly expense in Dubai was about 20% to 30% higher than that in France. Take note of this if you are planning to come to Dubai.

Expense categories

We track our expenses using our own Google Sheet, which we have fine-tuned over the years. We have built in a rudimentary multi-currency feature, and we can also add new categories as we see fit. If you are interested, you can get a Free copy here, and check the post with more details here.

Home

We track holidays expenses in its sub-categories such as rental, transportation, and F&B. This helps to visualize our categorical expenses and compare times we are traveling to times we are not. What I notice is that we spent 15% on rental vs 7% on holidays rental. Wow, I wasn’t aware that paying for a roof during those 3 holiday trips in a year cost as much as six months of accommodation! When I add the 6% for home maintenance (which includes tools and some furniture), and 2% for utilities (water and energy), our yearly accommodation-related expenses reached 30%.

Education

Same as Marcus Aurelius, we take education very seriously, and spend without too much restrain.

“From my great-grandfather: not to have attended schools for the public; to have had good teachers at home, and to realize that this is the sort of thing on which one should spend lavishly.”

― Marcus Aurelius, Meditations

Although we don’t hire private tutor (yet), we appreciate the possibility to send our children to private international schools. For now, it is difficult to assess the long-term impact as they are still very young. However, I can attest that our children are very happy going to school, and are learning new things every day. We spent about 14% for 2 older kids. In 2 years’ time, our third child will have to attend school and the expense will increase substantially.

Groceries and F&B

Groceries account for everything we buy from the supermarket, of which ~95% is food; while F&B includes all we pay for outside of our home, be it a nice meal or a takeaway. Since it is up to us to choose between eating in or out, we usually view the two together as food budget. Overall, it represents 16% of our annual expenses, of which 10%, 5% and 1% for groceries, F&B and Holidays F&B respectively.

Transportation

Transportation includes car insurance, car maintenance, toll fees, gas and fines, totaled a bit over 6% for the year. For simplicity sake, I did not include car depreciation here. This figure is dwarfed by the 8% we spent on holiday transportation which counts planes, car rentals and taxis. All in all, we spent 15% moving ourselves around, same as a roof over our heads!

Healthcare

We are very grateful to be healthy, which helped us to maintain a reasonable healthcare cost at roughly 6%. Most of it corresponds to the health insurance premium that we paid for. The healthcare in France is good and very affordable, and here in Dubai we are very well covered with SafetyWing. As mentioned before, SafetyWing is very suitable for families residing outside of their home countries. While most insurances ask for annual premium upfront, and are geographically limited, SafetyWing insurance is billed monthly, and covers us wherever we are for a very reasonable sum. We pay about US$170 per month for a family of 5. If you are interested, please sign-up on SafetyWing with this link.

Activities

Budget for activities is very important to us. As we do not have co-workers or a fixed group of friends near us, we want to fill our time with activities that we can share with others, which helps us keep a good life balance and discover new interests. My activity expenses are limited as I enjoy running and cycling, which can mostly be done free or charge. We like to sign our kids up for activities during the holidays, and extra-curricular activities after school. We believe it is important to expose them to different activities at an early age, so that they can discover their talent and interests. Recently, we enrolled our daughter to football and piano lessons. As a family, we all enjoy skiing in the winter. We tend to spend more on them than on us, for a total of 4%+ in 2022.

Tax

We always try to optimize our taxes but we can’t totally escape from it, even in Dubai. I would say, spending 2% of our annual expenses on tax is definitely acceptable.

Social, Misc, Telecommunications

Our telecommunication cost is kept low as we have prepaid packages with basic internet access, which are still more than enough to cover our needs. Social expenses are mainly gifts for friends and family. Misc is anything that do not belong elsewhere. We barely put expenses in this category as we usually don’t spend money on anything which isn’t worth to have a category of its own.

Relocation

We list relocation at the end of the analysis, at it is supposed to be a one-off expense every couple of years when we move around. Nevertheless, it is an expense to monitor closely as we spent nearly 10% of annual expenses for our move to Dubai. Ouch! Hiring a moving company with one 20-ft container costed us almost 50% more versus 3 years ago. And the supposedly tax-free Dubai still managed to charge us north of US$4,000 when we look at various fees and local taxes.

2022 Withdrawal rates

Let’s conclude this 2022 analysis by looking at our withdrawal rates. If you have been reading our posts, you know that we appreciate Big ERN’s approach and estimated our theoretical safe withdrawal rate (SWR) based on CAPE ratio. In the chart below, the blue dots represent monthly theoretical SWR, the red dots are our actual monthly WR, while the green line is the average WR for the year. The SWR increased by 10% during the year, while the market declined by about 20%. As we discussed in a previous post, net worth for retirees has little meaning when you don’t take CAPE ratio into account. What matters for retirees are withdrawals that you can afford without depleting a significant portion of your nested eggs.

Over the course of 2022, the SWR and our actual WR converged to ~3.2%. Thus, we managed to keep our expenses in check. However, there is not much buffer in our expenses before potentially risking a failure in 30 or 50 years. As with many of you, we felt the inflation squeeze and have been more frugal that we did in the past. We started to feel like “Two Gigs”, as in those living on limited data plan in the show Upload, and it was very unpleasant.

We hope you enjoyed our 2022 review. In this turbulent year, our portfolio dropped, but we managed to keep our expenses in check. The important takeaway for us is to stick to the designed plan as much as possible, while allowing some flexibility in the execution. How has 2022 been for you? What are your takeaways? Stay on course and Happy Fire Cracking!

One thought on “Our 2022 financials – expenses and withdrawals (part 2)”