2022 has been a roller coaster year for our portfolio and expenses. Nevertheless, we managed to stay calm although an impressive drop along the year. As we learned a few years back, the best thing to do is actually nothing, and let the storm pass. It is thus important to design a plan in less turbulent times, and stick to it when facing some headwinds.

Let’s review in details our family financials

Here we are. 2022 has just closed, and 2023 has just begun. It is time to look back and crunch 2022 numbers. Staring at the results, it is not exaggerating for me to say that 2022 has been a roller coaster year in terms of expenses and portfolio valuation. Hope you will draw some insights from our analysis below, and ready to take on whatever challenges 2023 has in store for you. Happy reading!

Our financials are split into two posts for the sake of clarity. The current part 1 is dedicated to the performance of our portfolio and the major asset class constituents. Part 2 is focused on expenses and withdrawals. Lots of learnings for us, and hopefully for you too.

Free Tools

To monitor the performance and asset mix of our portfolio, we have also created our own wealth management tool using Google Sheet. Please feel free to download and adapt the tool to your need here: GoogleSheet Wealth Management tool. We have dedicated a whole post to this tool as well: Best free FIRE wealth management tool.

If you find our tools useful, and would like to support us in our endeavor to share more tools with you, please consider a donation on the left side of the page. Thank you!

2022 Portfolio performance

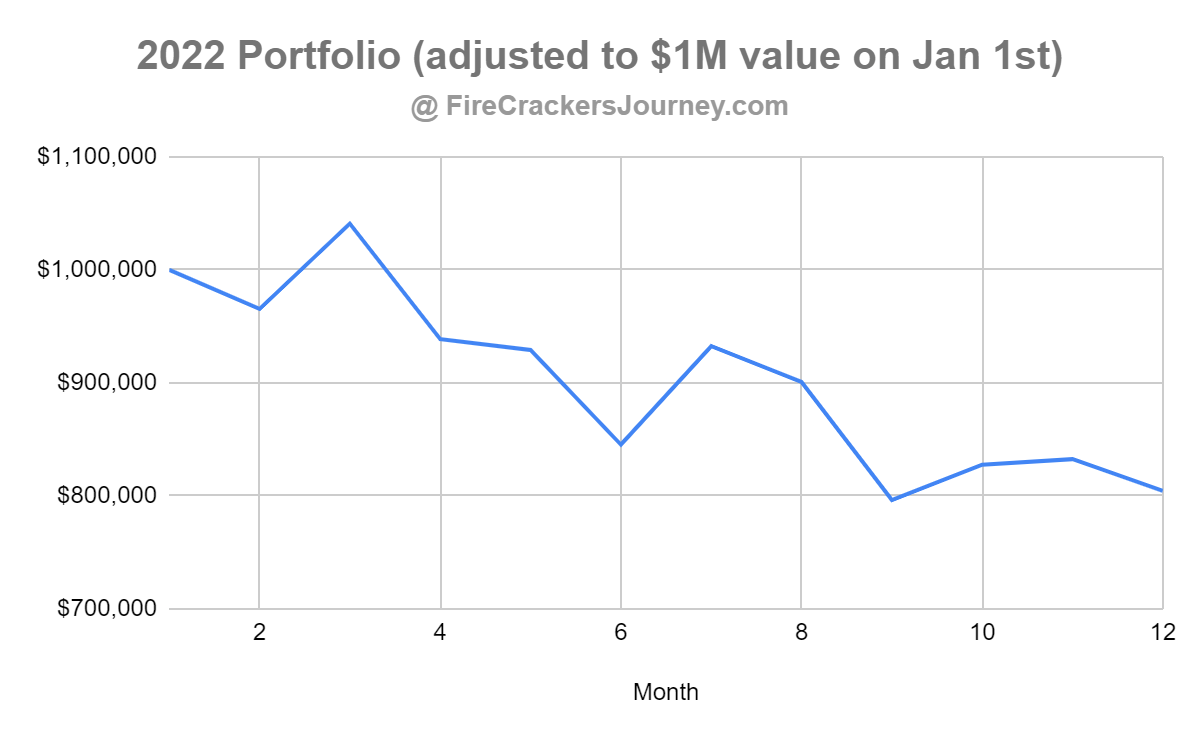

Without surprise, our portfolio dropped significantly during 2022. As a quick comparison, we normalized our portfolio so that it is valued at US$ 1million on January 1st, 2022. It was on an upward trajectory till March before its inevitable decline. The closing of the year reached a bit above US$805,000, thus a -19.5% return, which is perfectly aligned with the S&P 500 decline of -19.44%. The performance of our less risky assets such as bonds and cash mitigated our riskier assets in Nasdaq and crypto. Notwithstanding, as we used about 3.2% of our portfolio to finance our expenses, our net portfolio performance is closer to -16%.

It is frightening to see our portfolio decreasing at such an astonishing rate. During this year, one thought that saw us through was to remain calm and avoid panic sale. After spending many years observing the market, we understand that this ups and downs are part of a normal process. As we discussed before in Check out our FIRE Withdrawal Rate, portfolio and asset mix, our portfolio varied significantly since we FIREd. Fortunately, the sequence of risk return hasn’t been a disastrous storm, and our portfolio was able to grow in 2020 and 2021 before taking the hit in 2022.

2022 Asset Mix

We have been FIREd since November 2019, or at least when we stopped receiving any salary. Since then, we have been living out of our assets. Below is our portfolio holdings by categories: Stock, Reit, Bond, Cash, Crypto and Stablecoin.

Stock

As you can see, stock represents about 75% of our portfolio. These are mostly accumulating ETF. You can check our recommended ETFs in the post How to choose a good ETF?. During the year, stock hovered around 73% to 77%. We didn’t do any rebalancing. The variation is due to the value of the assets fluctuating with the market. In a volatile market like 2022, rebalancing at the wrong moments may simply incur more trading fees and underperform the overall market if you miss any major turns.

Reit

Just a few years ago, we had up to 15% of our assets in Reit generating a very good yield. This is the reason why we separated Reit from stocks as a category. However, dividends are usually taxed and distributing assets are not the most tax efficient vehicle. France, in particular, taxes heavily on cash dividends. Thus, we moved out of Reit, in favor of accumulating ETF which pays no dividends.

Bond

The share of bonds in our portfolio stayed around 14% throughout the year. Honestly, we were surprised that the bonds didn’t offer any mitigation to the unappealing stock performance. I guess we weren’t the only one to be surprised by it, as all asset classes plummeted following the war in Ukraine and the high inflation that followed. In hindsight, we would have been better off holding cash instead of bonds, as bonds declined along with stocks. Upon further analyses, we noticed that the positive correlation is more of a recent phenomenon. We will share more details in a future post.

Cash

Our cash position has ranged between 3% to 6%. We like to keep at least 6 to 12-months’ worth of expenses in cash. Yes I know, some of you may argue on the drag of cash on portfolio’s performance. For the record, we do agree with you. However, it gives us the serenity to sleep well at night. Indeed, it gave us comfort to know we do not have to sell depressed assets in a declining market. Our cash is always invested in cash deposit yielding interest. In 2023, the cash story could be different. For example, we deposit our cash in your Interactive Brokers account and earn +3.5% on deposit above US$10k. It doesn’t beat the crazy inflation we are facing, but at least it avoids the full destruction of value.

Crypto and stablecoin

We started to invest in early 2022, and we have been successful for some time. We stayed away from those too-good-to-be-true opportunities offering 15%+ on your crypto deposits. Glad we didn’t fall for them, as we avoided Luna, whose collapse triggered the fall of Celsius and other yield platforms, and the bankruptcy filing of the #2 largest trading platform FTX. Nevertheless, trust in the industry and value of most crypto assets largely evaporated after these events. To reduce impact of the swings, we first swapped some cryptos for stablecoins and generated good yield along the way. In the second part of the year, the yield on stablecoin was no longer offering much increment as compared with money parked with Interactive Brokers. Thus, we decided to swap the stablecoins back to fiat. We are still positive on the long-term performance of some cryptos, and happy to leave some of our wealth in this asset class.

What has been the performance of your portfolio in 2022? Have you been holding, or have you been trading? What have you learned this year and would like to share with our fellow readers? Let’s stay positive! 2023 has already made an impressive rebound. May the trend continue upward!

You can read our next post related to our expenses and withdrawals in 2022. Enjoy the reading!

One thought on “Our 2022 financials – portfolio and assets (part 1)”