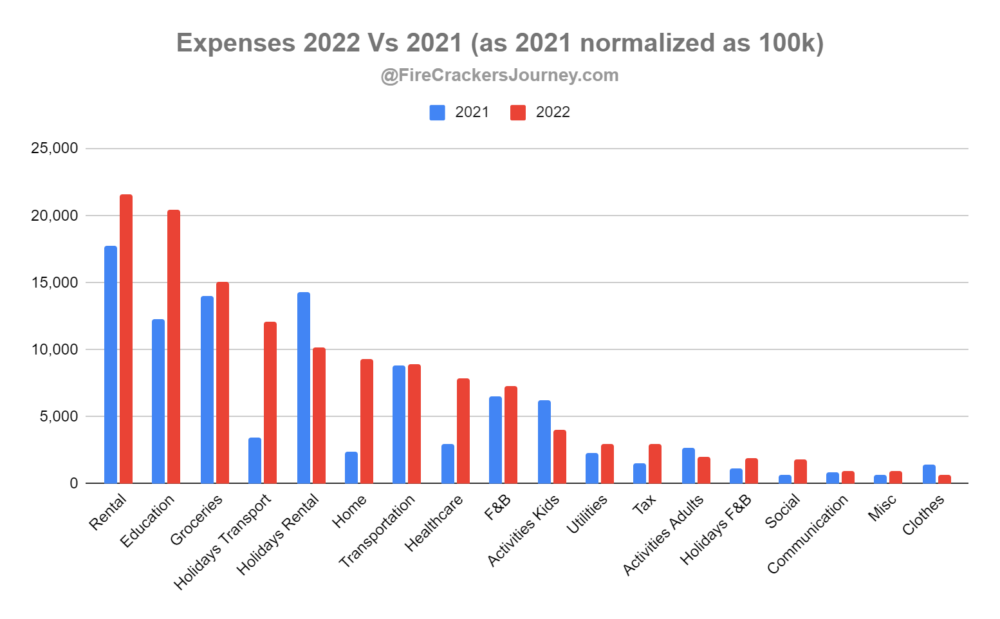

Moving to a new country is expensive. Moreover, inflation combined with a higher cost of living pushed our expenses beyond what we expected. We had to adjust our lifestyle and spending habits to keep our expenses within our budget.

Like this:

Like Loading...

Although we strongly recommend a simple buy and hold strategy of several diversified ETFs in a portfolio, we all made the mistake of individually picking a few stocks. Some have been more successful than others. Likely, you might still hold a couple of loss-making stocks. Understanding when you should sell them is critical to maximize their net value, and reduce your taxes, although they are not worth much.

Like this:

Like Loading...

Spain’s tax system is based on a progressive income tax, with rates ranging from 19% to 47% for personal income tax. Value-added tax (VAT) is a major source of government revenue, with a standard rate of 21%. Other taxes include wealth tax, inheritance tax, and taxes on property and capital gains. The government also collects social security contributions from employees and employers. As early retirees with significant capital and low income, we will delve into tax residency, investment income and wealth tax.

Like this:

Like Loading...