Moving to a new country is expensive. Moreover, inflation combined with a higher cost of living pushed our expenses beyond what we expected. We had to adjust our lifestyle and spending habits to keep our expenses within our budget.

Cost of living indicators are mere information

When we researched about cost of living in Dubai, we looked at Numbeo. It is a website which offers many indicators about cost of living, property prices, quality of life indicators. We used it as a gauge to estimate the impact on our budget before moving to Dubai. It is important to understand that most of the data are provided by users, and that the model that they used might be different from the expenses’ structure for your family.

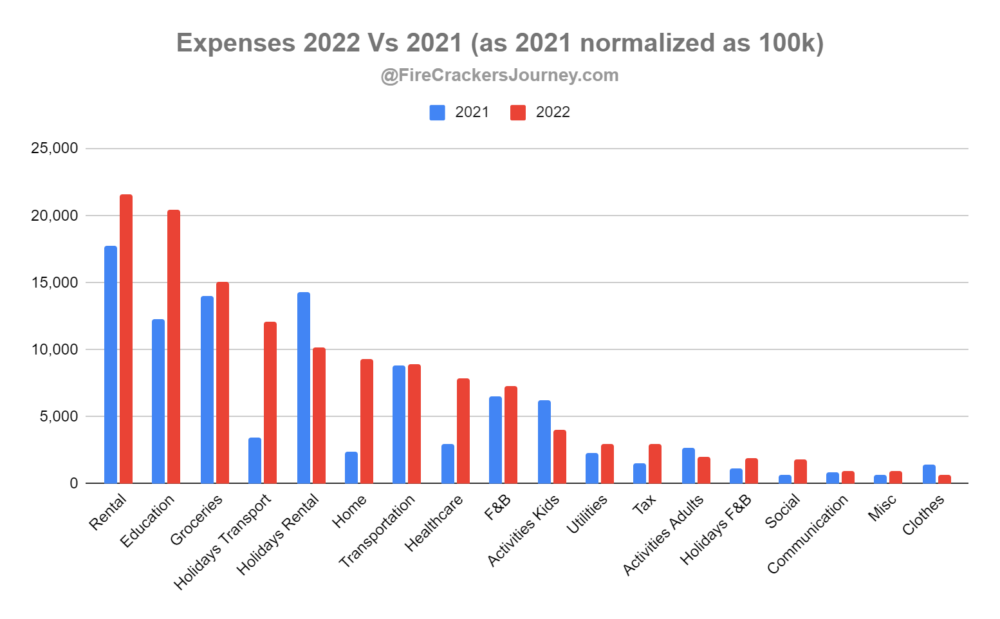

Based on their cost of living comparison tool, we were supposed to need 15% more in Dubai to maintain the same standard of life compared to where we used to live. CPI was supposed to be lower, but rent more expensive. However, the figure came out very different. Excluding our costs related to the relocation (supposed to be a one-off cost), our expenses increased by 31% while we adapted our consumption patterns to minimize our costs! Let’s review the biggest expense categories which drive most of the costs, and understand the sources of the increase.

Relocation to Dubai costed us US$12,300!

As mentioned above, let’s exclude these costs from our cost of living expenses. Indeed, it is supposed to occur when we move, not a recurrent cost. Nevertheless, it is important to budget for these costs if you are planning to relocate to Dubai.

Two third of these costs are associated with the logistics (mover and sea container fees). These fees should be spread over the years that we will stay in Dubai. The balance one third of the costs are related to the visa fees for a family of five for a one-year visa. There are many schemes that you can use to obtain a visa. And fees can fluctuate significantly. For example, you can invest a certain amount of money in real estate, and you will be eligible for a golden visa for your whole family. An investment of AED 2 million (~US$545K) will grant your 10-year Golden Visa. Another option is purchasing real estate for AED 750,000 (~$204K) to get a 2-year residence visa. It can be an interesting proposition if you plan to settle in Dubai. For us, we went for the less expensive visa and assess if the place was a good fit for our family.

Even if you split the logistics costs over 3 years, and add the recurrent visa fees, you should budget for about $5,000 costs per year.

In Dubai, our recurrent expenses increased by 31%!

It is no small increase and many factors contributed to this increase. Globally, there has been a surge of inflation. Inflation varies from one country to another one. Let’s assume that wherever we would have been, we would have experienced an inflation of roughly 10%. Nevertheless, there is still some variance to explain.

Housing costs jumped by 83%

In France, we were living in a modest 3-bedroom apartment of 83m2. In Dubai, we moved in a community with family facilities (kids playground, swimming pool and tennis) in the outskirt of Dubai. We are renting a 3-bedroom townhouse of ~130m2. Rooms are spacious and we could live in a smaller place. However, appartements or houses in Dubai are quite spacious. We choose a place which was in the lowest range of rent that we could find. In the span of one year, we could see the housing market shooting up. When we researched in May 2022, a 4-bedroom house was going for AED 140,000 (~US$38K) per year in Arabian Ranches 2. When we arrived in August 2022, we could only offer ourselves a 3-bedroom house for AED 165,000 (~US$45K) per year. We felt that it was ridiculous. Thus, we looked at other further communities to keep our rent low (according to Dubai standards).

Education is 25% more expensive

In 2021, we had 1 child in school the full year, plus another child for half a year. So, we had 1.5 children in school in 2021. However, in 2022, both of our eldest kids were in school. Taking that into account, education cost in Dubai is 25% higher than the private education in France. And the school fees of the school we choose in Dubai are already in the low average. Whereas in France, you can still opt for a free public education, here in Dubai you must enrol your children in a private institution.

There are extra costs like uniforms and school materials that you need to buy. There is a large offering of Extra Curriculum Activities, but it will also come with a price. Finally, bus services are fantastic as they pick your kids from your door, and drop them back at the end of the day. Again, it comes with a price ranging from AED 500 (~US$136) to AED 1,000 (~US$272) per month per kid depending on where you live and the school. After using the bus service for two months, we decided to drive our kids to/from school. Furthermore, we opted to prepare lunch boxes for the kids when they go to school. Now we can see when they are back home how much food they had eaten, and save on the school lunch fees (~US$8 per kid per day).

Groceries and F&B increased modestly by 9%

Indeed, the increase is aligned with inflation. We are pleased to maintain a healthy and budget conscious diet. However, we had to adapt our eating habits. We now eat more shrimps and fishes are they are cheaper than in Europe. However, meat is more expensive. Prices of fruits and veggies are everywhere. Some are cheaper than in Europe, some are simply ridiculous. It is important to remain vigilant when you are filling up your basket of groceries.

Holidays ballooned by 28%

It has very little to deal with Dubai. Since we arrived in UAE, we went on holidays only once and by road. We had an amazing time driving in Oman, exploring wadis and visiting Muscat. Most of our travel’s costs occurred before we arrived in Dubai. We travelled to Singapore and Canary Island. We also came twice to Dubai. Once in May to check out the place, and one in August for our relocation trip. All these trips add up quickly especially for a family of 5. Our youngest was still an infant, and tickets were cheap. Starting next summer, she will need a child seat.

Home expenses multiplied by almost 3 times

When we moved to Dubai, we brought our dishwasher and washing machines. Although housing is more expensive here, the house was free of a stove, cooker or a fridge which we had to buy. On top, we also had to put some fake grass in the garden, and install storage shelves in the laundry room and the garage. We will keep or sell the appliances when we will leave. However, the house improvement costs are simply sunk costs.

Additionally, we hired a nanny when we moved in Dubai. She provides great care for our 1-year-old baby, and also our home. She delivers fantastic service to us and our family. Having a full time live-in nanny isn’t cheap, but she is worth every penny.

Transportation costs are flat

It is worth noting that our transportation costs (excluding holidays) remained flat. It accounts for car insurance, car maintenance, gas, parking and fines. I exclude the cost of the car and its depreciation, as I have never accounted for yet. It is for ease of comparison. Moreover, we only drive modest but secure and reliable car. Thus, the car looses very little value over time.

Although gas is about 60% cheaper in UAE versus France, we drive much more in Dubai. The city is much spread out, and it is very likely that any journey will be at least a 30-minutes’ drive.

“Housing, Education, food and holidays expenses already account for 80% of our annual costs with an average 30% cost increase.”

Healthcare, Utilities, Communications and Activities

The rest of our expenses are also aligned with a 31% cost increase, although we have also been very cautious with our expenses. Healthcare is definitely more expensive in Dubai. A visit to the medical GP will be north of ~US$110, but so far, touch wood!

Electricity and water are relatively cheaper than in France. However, there is a 5% municipality fee of your rent added to your monthly DEWA bill.

Mobile plans and internet are very expensive compared to Europe. We used to have 2h of voice with at least 20 Go for less than US$10 per month. Here for the same price, you can barely afford the cheapest plan (30min call with 2/4 Go of data), and you prepay for a full year! Regarding the internet, we had super fast fiber for less than US$30 a month in France. Here in Dubai, we pay AED 199 (~US$54) for a router with a 4G simcard. Moreover, you will need a private VPN, as Skype and WhatsApp calls are blocked.

There are very few free activities in Dubai. During the short few months of winter, you can enjoy some outdoor at the beach or in a paid park. Rest of the year, you will have to handle your credit card in order to enjoy any indoor activities.

Relocating is about experience, not only money

Overall, I think that we controled our costs the best we could. We could have opted for an apartment instead of a house. But the rent savings would not have been significant, as we are already in the suburbs of Dubai. Regarding education, we are very pleased with the school. Kids have made lors of friends and are learning new skills everday. It is an area where we are happy to spend money, although this school is relatively affordable. Finally adapting what we eat to what is available locally on the shelves really help to maintain our food bill under control.

Beside money, moving to a new country is about experiences. There is no real point to live the same way, eat the same food and experience the same activities like before. Since we arrived in Dubai, we have adapted our activities, our lifetsyle and diet. We have learnt a lot about ourselves, about new cultures and understand what we are willing to trade. They are aspects of our previous home that we prefer, and others that we are glad to have changed. In the end, it is up to you to decide what is the best compromise. If you haven’t read Perfection is an illusion. Life is about compromise, I invite you to.

How about you? How have been your expenses in 2022 versus 2021? Have you experienced 10% or more of price increases? How are you dealing with it? Hope it doesn’t affect your lifestyle too much, and you are still on the trajectory to Fire. Happy Fire Cracking!