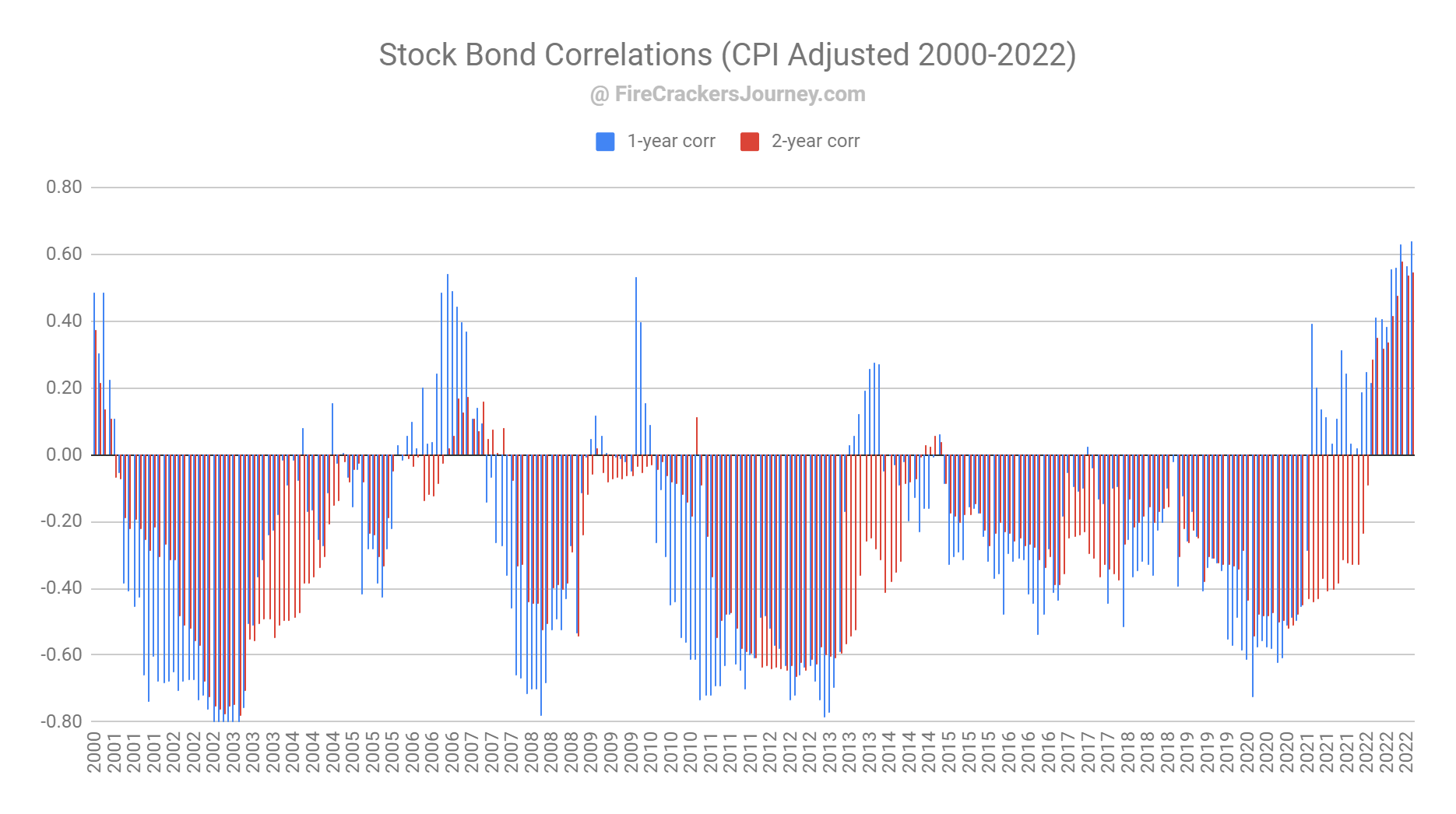

Adding Bonds to a portfolio is supposed to reduce volatility, offer diversification and hedge against a bear market. It used to be true but not anymore. Recently bonds switched from negatively to positively correlated with stocks. What does that mean for your portfolio?

Like this:

Like Loading...

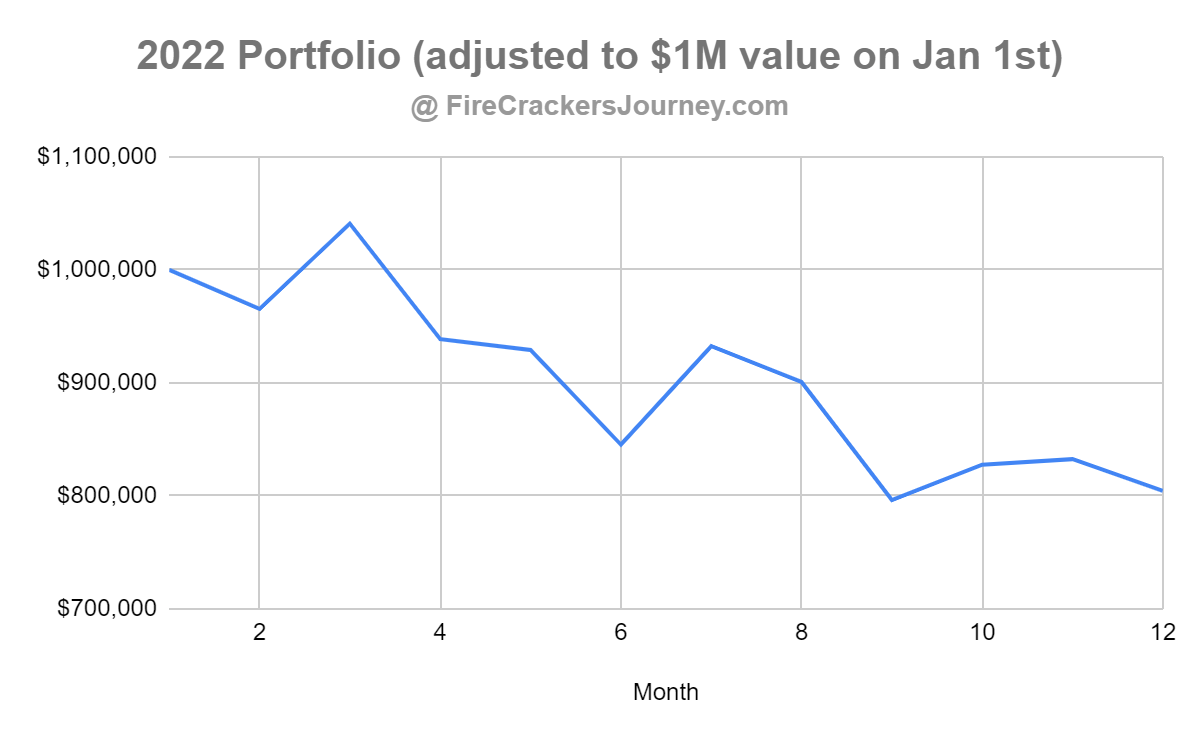

2022 has been a roller coaster year for our portfolio and expenses. Nevertheless, we managed to stay calm although an impressive drop along the year. As we learned a few years back, the best thing to do is actually nothing, and let the storm pass. It is thus important to design a plan in less turbulent times, and stick to it when facing some headwinds.

Like this:

Like Loading...

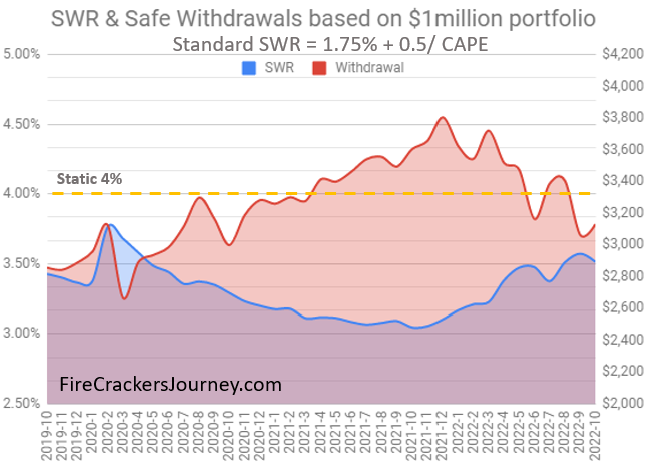

Although our asset mix, portfolio value and CAPE ratio evolved over time, Big ERN’s Safe Withdrawal Rate formula helped us navigate through the past turbulent 3 years, and strategize our distribution strategy. Portfolio valuation needs to be examined with the CAPE ratio to be meaningful.

Like this:

Like Loading...

Invest regularly into Stock ETF, then add Bond ETF to your portfolio when you are 5-10 years away from your retirement. Thank

Read More

Like this:

Like Loading...