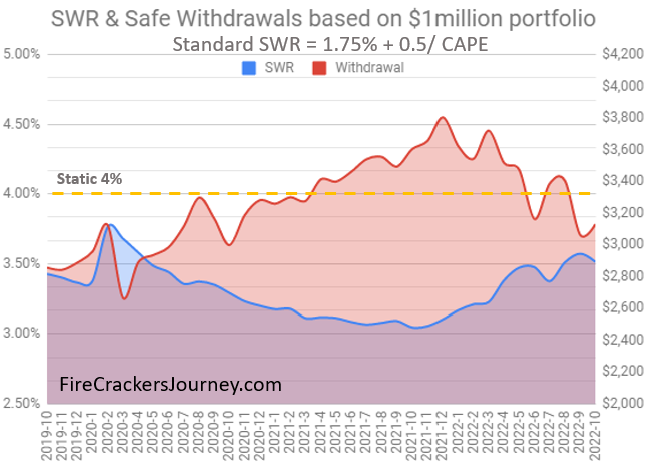

Although our asset mix, portfolio value and CAPE ratio evolved over time, Big ERN’s Safe Withdrawal Rate formula helped us navigate through the past turbulent 3 years, and strategize our distribution strategy. Portfolio valuation needs to be examined with the CAPE ratio to be meaningful.

Like this:

Like Loading...

An increase in revenue or a decrease in expense leads to the same benefit of increased saving and investing. Pivot your point of view, track and reduce expenses and enjoy the extra money.

Like this:

Like Loading...

Once you take a step back and observe the system, you will understand its mechanics and uncover its rules. Now use that knowledge to your advantage and crack the system to your benefit!

Like this:

Like Loading...

My humble thoughts would be to invest regularly in S&P500 index or All-World index, then add US Treasuries 10 years when you are 5-10 years away from your retirement. Accumulating ETFs are usually more tax efficient.

Like this:

Like Loading...

It does feel great, although the feeling doesn’t match the expectation. A mindset shift happens, and you perceive the world differently.

Like this:

Like Loading...

Interactive Brokers is the best online broker, offering the cheapest transaction fees and access to a large spectrum of assets, accessible from

Read More

Like this:

Like Loading...

Invest regularly into Stock ETF, then add Bond ETF to your portfolio when you are 5-10 years away from your retirement. Thank

Read More

Like this:

Like Loading...

Target to save and invest at least 50% of your money if you want to retire within 20 years. Or aim to

Read More

Like this:

Like Loading...

Our FIRE journey started with some basic assumptions and calculations on the back on an envelope. Then our project took shape, and

Read More

Like this:

Like Loading...