Adding Bonds to a portfolio is supposed to reduce volatility, offer diversification and hedge against a bear market. It used to be true but not anymore. Recently bonds switched from negatively to positively correlated with stocks. What does that mean for your portfolio?

Benefits of Bonds

Reduced volatility

Bonds offer reduced volatility in a portfolio due to their unique characteristics, and the way they behave in relation to other assets in the market.

Firstly, bonds are generally less volatile than stocks, meaning they tend to fluctuate less in price over time. This is because bonds represent a fixed income stream and have a defined maturity date, whereas stocks have no maturity date, and their value is based on the future growth potential of the company. This makes bonds a more stable investment and reduces the overall volatility of a portfolio.

Secondly, bonds provide regular interest payments, which can provide a steady source of income regardless of market conditions. This income can help offset any losses from other investments and provide stability to a portfolio.

Overall, adding bonds to a portfolio can reduce volatility by providing stability and a regular income stream.

Increased diversification

Bonds are a type of fixed income security that represents a loan made by an investor to a borrower, typically a government or a corporation. As such, bonds have a defined maturity date and pay a fixed interest rate or coupon over the life of the bond. This contrasts with stocks, which represent ownership in a company and do not have a fixed maturity date or fixed income stream.

Additionally, there are different types of bonds with varying degrees of risk and return. For example, government bonds are generally considered less risky than corporate bonds, and high-yield bonds are considered riskier than investment-grade bonds. By diversifying across different types of bonds, investors can manage risk and potentially earn higher returns than they would by investing solely in stocks.

Finally, adding bonds to a portfolio can increase diversification by providing exposure to a different asset class, varying degrees of risk and return, and a regular income stream. This can help manage risk and potentially improve overall returns.

Are bonds negatively or positively correlated with stocks?

I have heard many times that bonds have a negative correlation with stocks, which means that when stocks are performing poorly, bonds tend to perform well. Indeed, I can easily find sources online describing that stocks and bonds are negatively correlated.

However, there are very few resources stating the opposite. As an example, Is the Stock-bond correlation positive or negative? post by Russell Investments asks the correct question. However, they only look at the time frame between 1989 and 2021, which is narrow. It would be interesting to analyse the correlation over a larger time span.

This negative correlation is supposed to provide a buffer against market downturns and reduce the overall risk of a portfolio. However, when I checked our portfolio, I didn’t feel that our bonds were negatively correlated. So, let’s run the analysis ourselves and see if bonds are negatively or positively correlated over a long period of time.

What is correlation?

Correlation between two asset classes refers to the degree to which the prices or returns of the two assets move in relation to each other. A positive correlation means that when the price of one asset increases, the price of the other asset also tends to increase. A negative correlation means that when the price of one asset increases, the price of the other asset tends to decrease.

Correlation is measured on a scale of -1 to +1, where a correlation of +1 represents a perfect positive correlation, a correlation of -1 represents a perfect negative correlation, and a correlation of 0 represents no correlation at all.

By including assets that have a negative or low correlation with each other, investors can reduce the overall volatility of their portfolio and potentially improve returns. This is because when one asset class is performing poorly, another asset class may be performing well, providing an hedge against market downturns.

However, it is important to note that correlation is not static and can change over time. Economic and market conditions can affect the correlation between asset classes, and investors should regularly review and adjust their portfolio to ensure that it remains diversified and aligned with their investment goals and risk tolerance.

Correlation over 1-, 2-, 5- or 10-year period?

Correlation measures the covariance between the returns of two assets over a specific period of time. We can look at the correlation between stocks (let’s take S&P500) and bonds (let’s take US Bonds 10 years) over a 1-year, 2-year, 5-year or even a 10-year period.

A 1-year period might be too short to observe any change or trend. On the other side, over 10-year period, lots of data are muted because of the long length of time. Nevertheless, it can offer a vision if there has been a change in a cycle. Thus 2- and 5-year seems to be an interesting proxy to observe any trend especially considering the speed at which markets evolve nowadays.

In the analysis below, I will share the full 1-,2-, 5- and 10-year period of correlation so you can judge by yourself.

Stocks vs Bonds correlation

For our first chart below, I just plug the raw data, without adjusting data with inflation. It is difficult to extract any clear pattern, as the correlation keeps swinging vastly between +0.8 to -0.8 every couple of years between 1892 and 2022.

Thus, I adjusted the returns with the Consumer Price Index (CPI). CPI is often used as a proxy to measure inflation. It actually makes more sense to analyse data adjusted by CPI, because as investors, we care about real returns, not simply nominal returns. Thus, going forward, we will look at the real returns’ correlations.

10-year correlation

Now, you can clearly identify 4 major blocks:1892-1929 (+0.4 correlation), 1940-1958 (between +0.05 to +0.4 correlation), 1970-2002 (between +0.2 and +0.4 correlation), and then 2002-2022 (between 0 and -0.4 correlation). Thus, the negative correlation, over a 10-year period, is more a recent phenomenon. Indeed, only during the last 20 years compared to the last 130 years were the correlation negative over a significant period of time. Most of investors have thus experienced a negative correlation during their working life, and might have taken it for granted or universal truth. However, this is a mistake.

5-year correlation

As we mentioned before, 10-years analysis tend to mute lots of data. Let’s remove the 10-year and focus now on the 5-year correlation (in orange).

Similarly, we would now observe 6 major blocks. Four similar to the 10-year correlation, and two new ones. For the similar blocks 1892-1929 (+0.2 to +0.5), 1940-1958 (+0.2 to +0.4), 1970-2002 (+0.2 to +0.55) and 2002-2022 (-0.2 to -0.5), the correlations are within the same range, however there is more fluctuations in a 5-year correlation. In this 5-year correlation, we can identify two new periods: 1929-1945 (correlation oscillates between -0.05 and +0.05) and in 1958-1963 (correlation went negative and reached -0.25).

It is interesting to observe the difference between the 5-year and 10-year analysis. Although we have similar trends, the 10-year smooths the data, whereas the 5-year shows more details.

2-year correlation

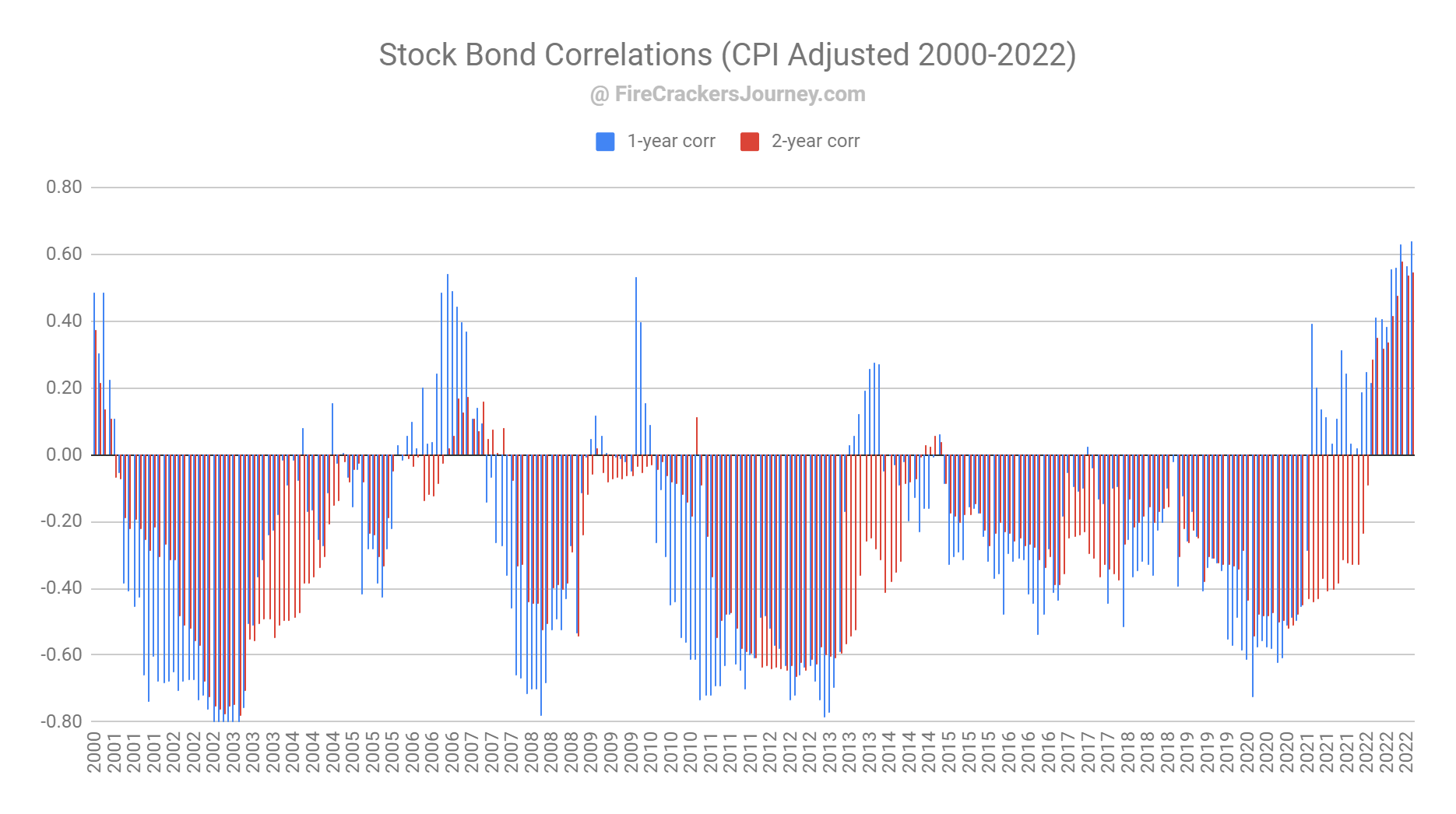

As expected, this chart has much more variation. Again, less smoothing of the data because of the shorter timeframe for the analysis. Nevertheless, as we just observe major blocks by analysing 5- and 10-year correlation, we can still identify the major trends or blocks. However, have you noticed a change on the right side of the chart?

Now that we zoom in on the last 20 years, we can see that bonds have mostly been negatively correlated with bonds. However, since 2021 for 1-year correlation, and 2022 for 2-year correlation, bonds have turned positively correlated, and the correlation is now almost +0.6! Honestly, I am surprised that it hasn’t been more spoken about. I used to invest in bond partially because of the negative correlation that we enjoyed over the last 20 years. With stock markets been in a downturn since the end of 2021, bonds haven’t offered the hedge against the bear market. Holding cash might have been a better investment!

How much bonds do we have in our portfolio?

At the beginning of our investment journey, we had a good 30% of bonds in our portfolio, as we were following the recommended 60/40 stock/bond portfolio. We were a bit overweighted in stocks because we were fine to experience a high volatility in our portfolio in order to get higher return. Also, we were invested in corporate bonds with a Yield to Worst (YTW) above 5%, not the typical long-term US Treasuries. Looking back we should have had even more stocks and less bonds at the beginning of our investment journey.

As we were getting closer to Early Retirement, we were in the 25% range of bonds in our portfolio. Although, the overall proportion of bonds has reduced, we removed almost all corporate bonds, and replaced with long term treasuries. Now, we have reduced our bonds to 15% in our portfolio. You can review the allocation in our previous post Check out our FIRE Withdrawal Rate, portfolio and asset mix.

Should we replace bonds in our portfolio?

The negative correlation which used to be a key characteristic of bonds is no longer valid. Thus, the true assertion should now be: bonds have a positive correlation with stocks, which means that when stocks are performing poorly, bonds tend to perform poorly too.

However, bonds still offer diversification and reduced volatility in a portfolio. So, with this amount of information, it will be a mistake to ditch bonds from your portfolio. The question should be what asset class should you replace your bonds with? Should it be simply holding Cash which has no correlation with stocks? Should it be Commodities, as there are the main drivers behind inflation? Should it be Real Estate because of the steady income stream?

In a future post, we will explore the new shape of the efficient frontier in our new environment where stocks and bonds are positively correlated, with a high inflation and high interest rates.

How much bonds do you have in your portfolio and at which stage of your fire journey are you ? Do you plan to change your bond allocation? What would be your ideal asset allocation in your portfolio? In the meantime continue saving and investing, and ultimately Happy Fire Cracking!

Very interesting article, Bond rates especially Gov are used as an economic tool and can’t really perform this traditional negative correlation benefit. I eliminated Bonds from my Portfolio a couple of years ago to go much heavier on stocks and introduced a Gold allocation as a buffer to volatility. Interested in knowing your perspective on using commodities as replacements for bonds for this purpose.