Taxes can significantly impact your financial performance. Delaying taxes or strategically offsetting them with capital losses can greatly enhance your investment returns.

Like this:

Like Loading...

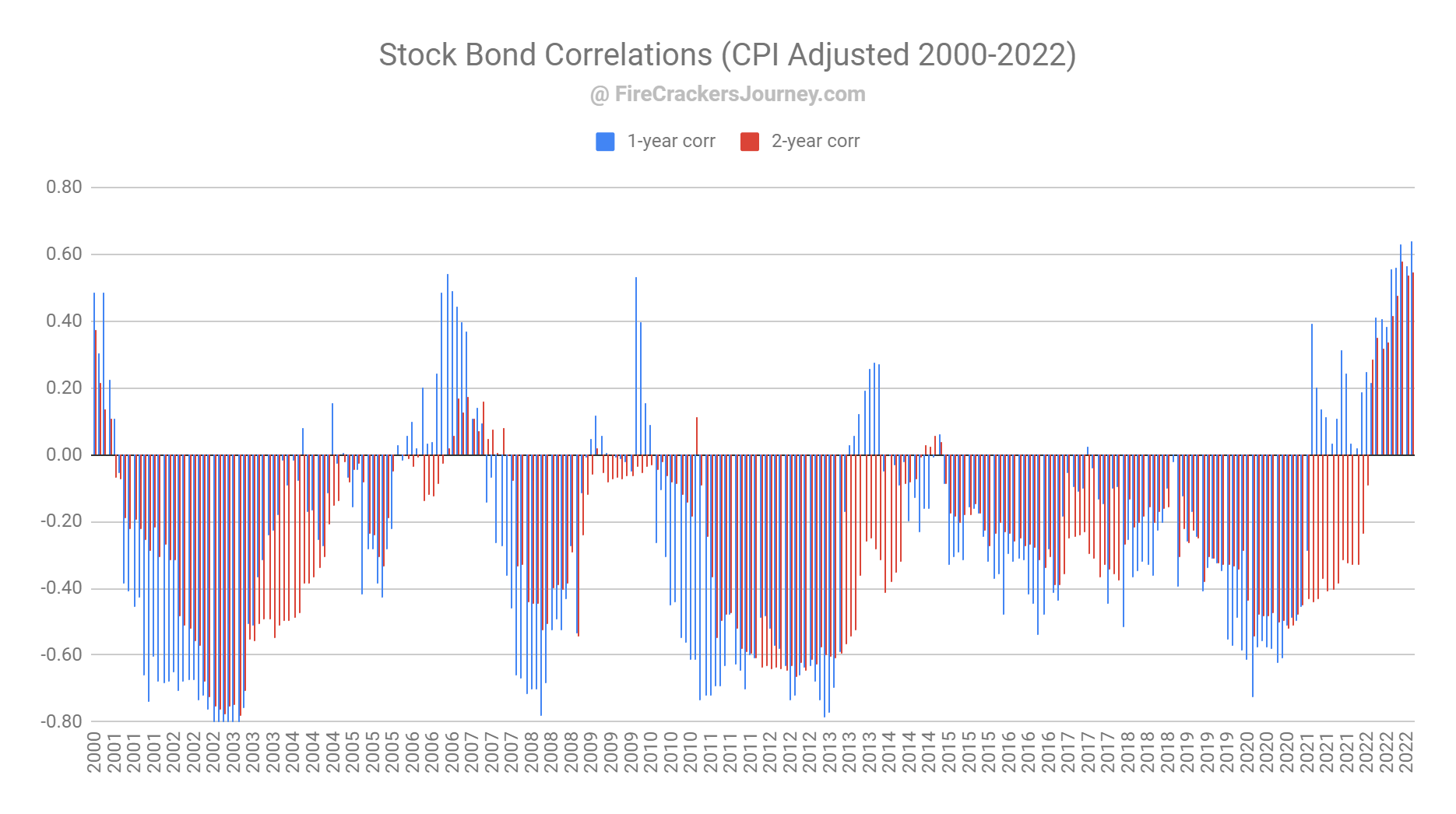

Adding Bonds to a portfolio is supposed to reduce volatility, offer diversification and hedge against a bear market. It used to be true but not anymore. Recently bonds switched from negatively to positively correlated with stocks. What does that mean for your portfolio?

Like this:

Like Loading...

Although we strongly recommend a simple buy and hold strategy of several diversified ETFs in a portfolio, we all made the mistake of individually picking a few stocks. Some have been more successful than others. Likely, you might still hold a couple of loss-making stocks. Understanding when you should sell them is critical to maximize their net value, and reduce your taxes, although they are not worth much.

Like this:

Like Loading...

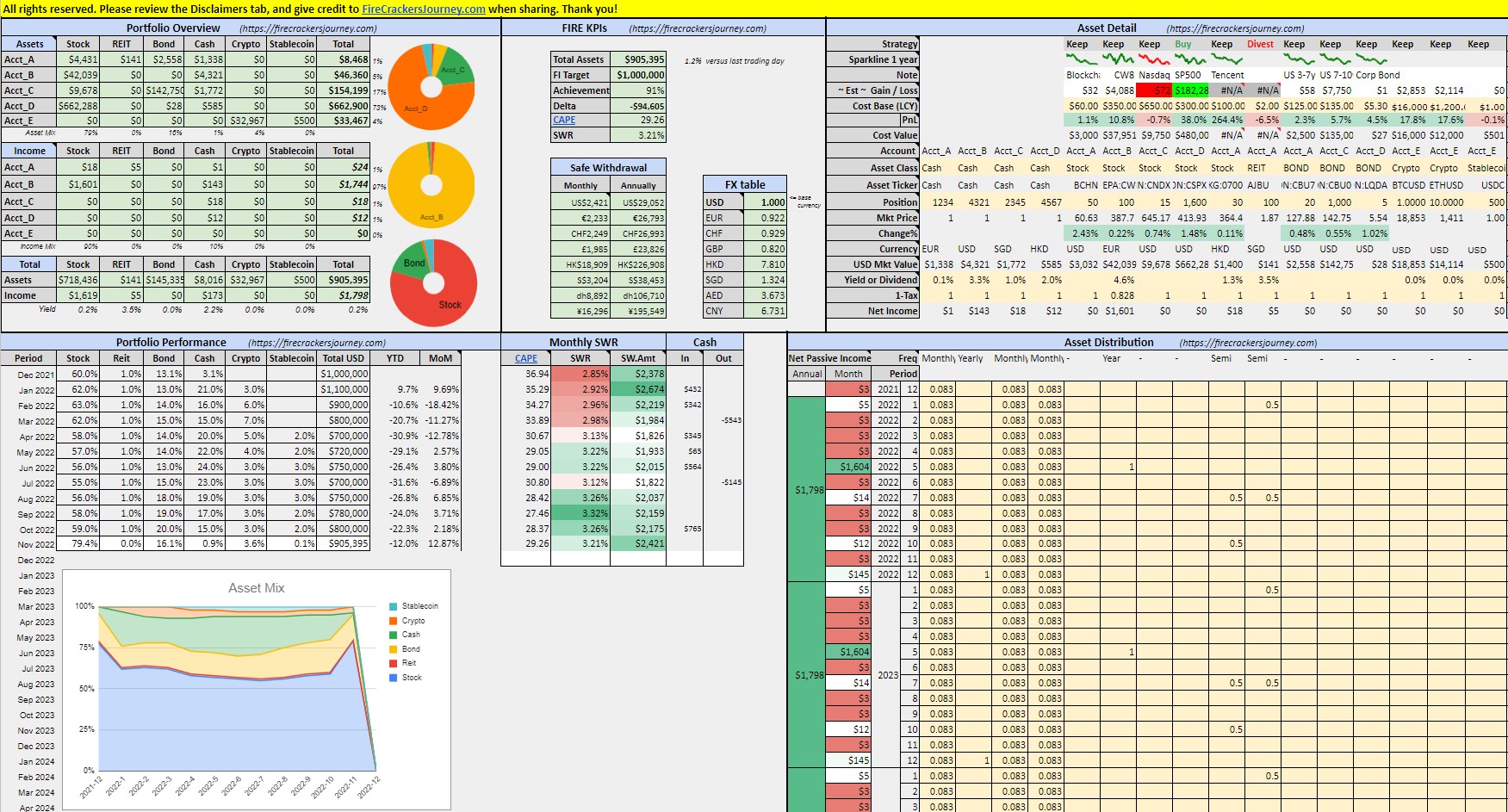

Build a consolidated view of all your assets (multi-currency and multi-location) in a single FIRE wealth management tool for FREE, and estimate your monthly Safe Withdrawal amounts based on CAPE ratio.

Like this:

Like Loading...

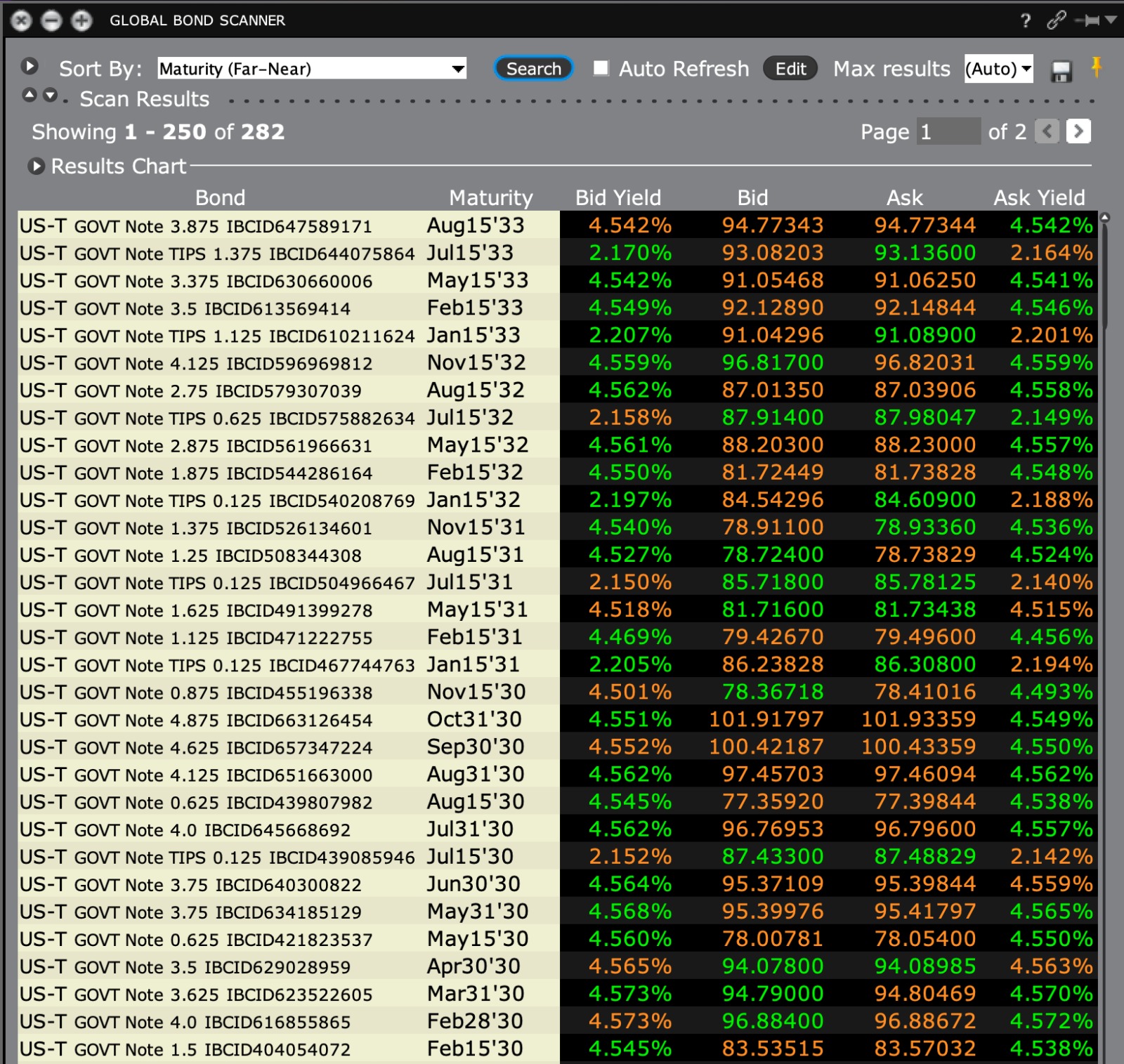

Interactive Brokers is the best online broker, offering the cheapest transaction fees and access to a large spectrum of assets, accessible from

Read More

Like this:

Like Loading...

Invest regularly into Stock ETF, then add Bond ETF to your portfolio when you are 5-10 years away from your retirement. Thank

Read More

Like this:

Like Loading...