Best free FIRE wealth management tool

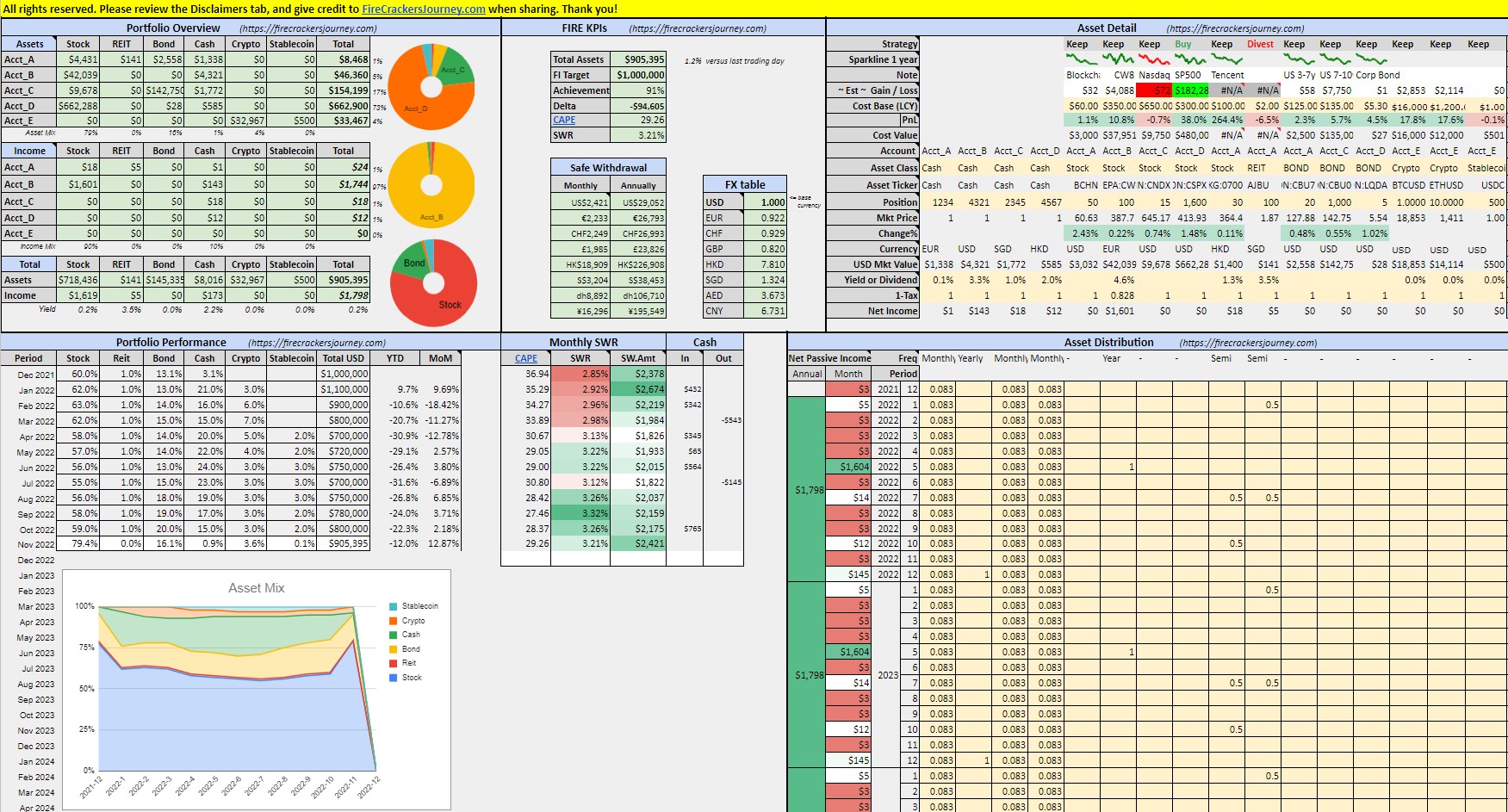

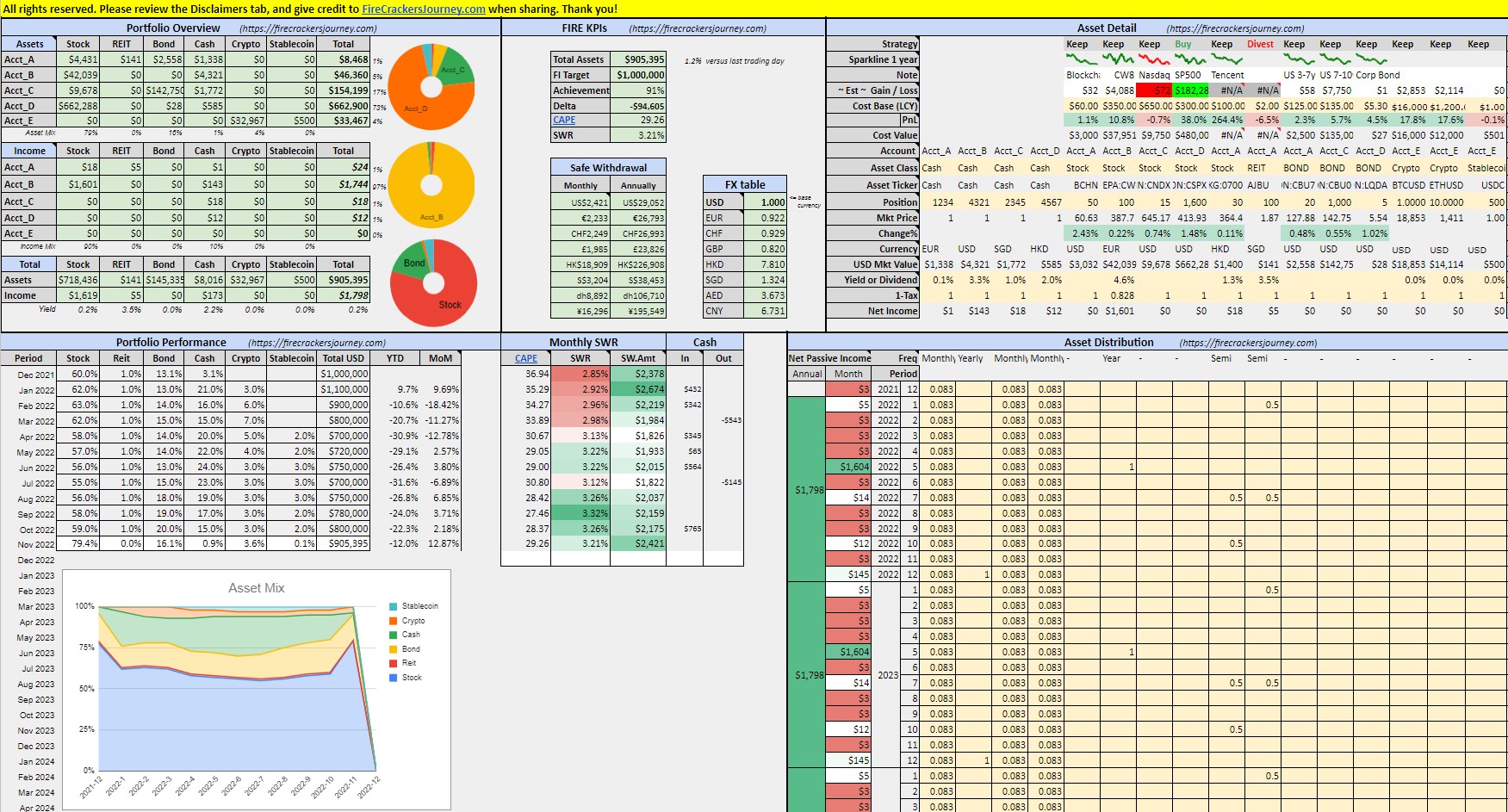

Build a consolidated view of all your assets (multi-currency and multi-location) in a single FIRE wealth management tool for FREE, and estimate your monthly Safe Withdrawal amounts based on CAPE ratio.

Build a consolidated view of all your assets (multi-currency and multi-location) in a single FIRE wealth management tool for FREE, and estimate your monthly Safe Withdrawal amounts based on CAPE ratio.

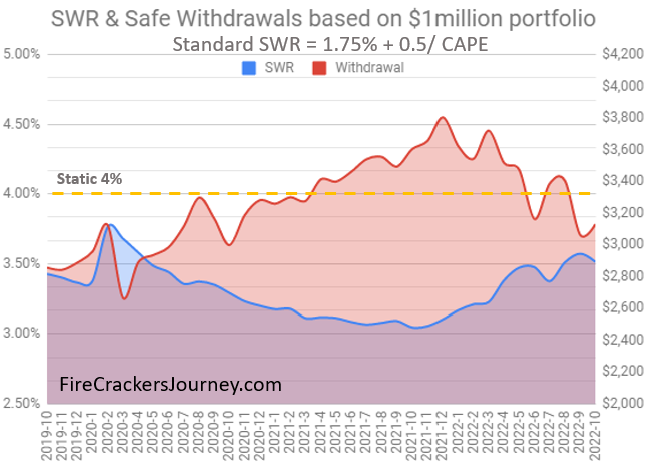

Although our asset mix, portfolio value and CAPE ratio evolved over time, Big ERN’s Safe Withdrawal Rate formula helped us navigate through the past turbulent 3 years, and strategize our distribution strategy. Portfolio valuation needs to be examined with the CAPE ratio to be meaningful.

My humble thoughts would be to invest regularly in S&P500 index or All-World index, then add US Treasuries 10 years when you are 5-10 years away from your retirement. Accumulating ETFs are usually more tax efficient.

Target to save and invest at least 50% of your money if you want to retire within 20 years. Or aim to

Hey,

it seems that you enjoy reading our blog. If you don’t want to miss any new post, just fill up your name and email!