Taxes can significantly impact your financial performance. Delaying taxes or strategically offsetting them with capital losses can greatly enhance your investment returns.

Like this:

Like Loading...

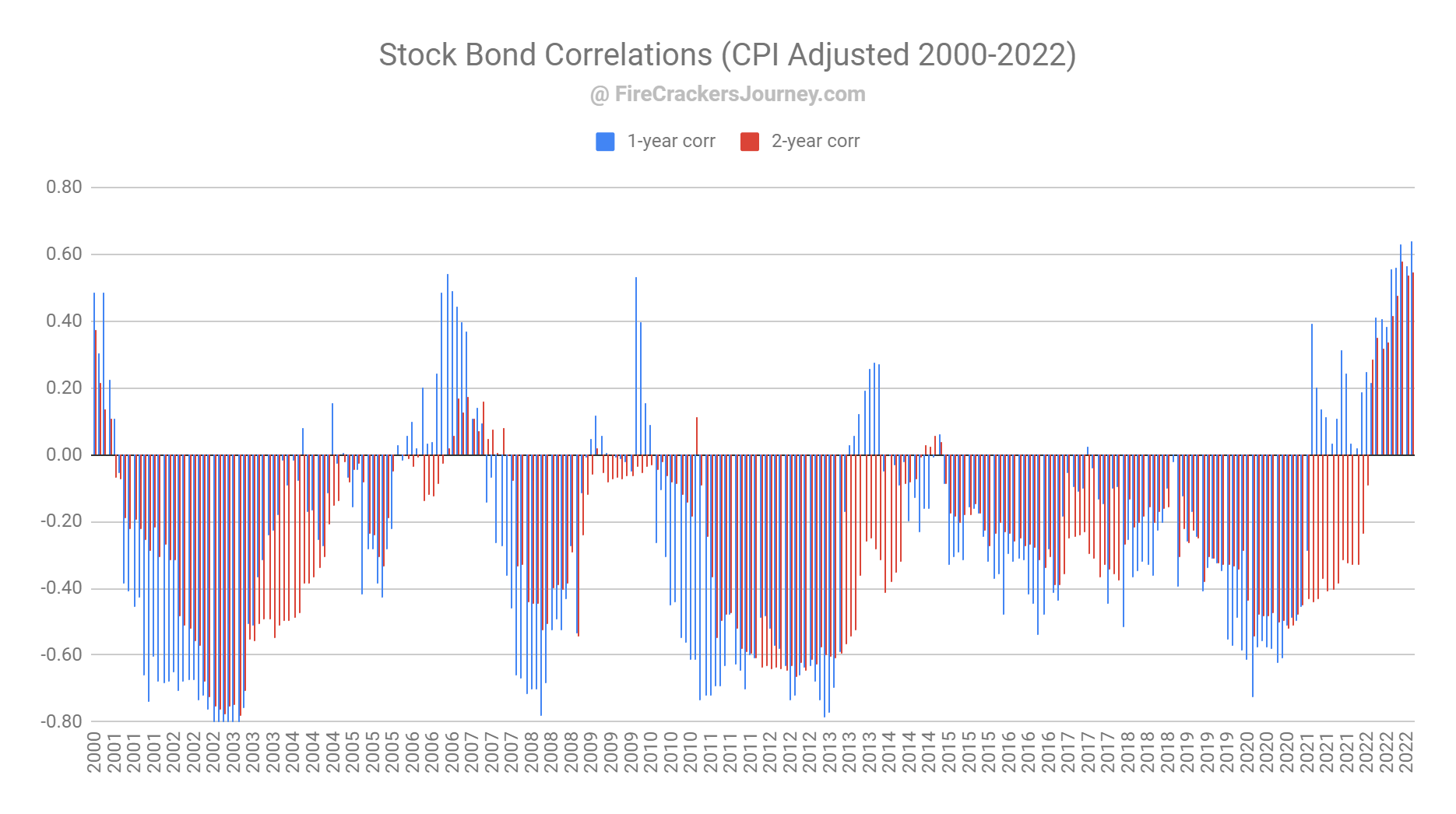

Adding Bonds to a portfolio is supposed to reduce volatility, offer diversification and hedge against a bear market. It used to be true but not anymore. Recently bonds switched from negatively to positively correlated with stocks. What does that mean for your portfolio?

Like this:

Like Loading...

Although we strongly recommend a simple buy and hold strategy of several diversified ETFs in a portfolio, we all made the mistake of individually picking a few stocks. Some have been more successful than others. Likely, you might still hold a couple of loss-making stocks. Understanding when you should sell them is critical to maximize their net value, and reduce your taxes, although they are not worth much.

Like this:

Like Loading...

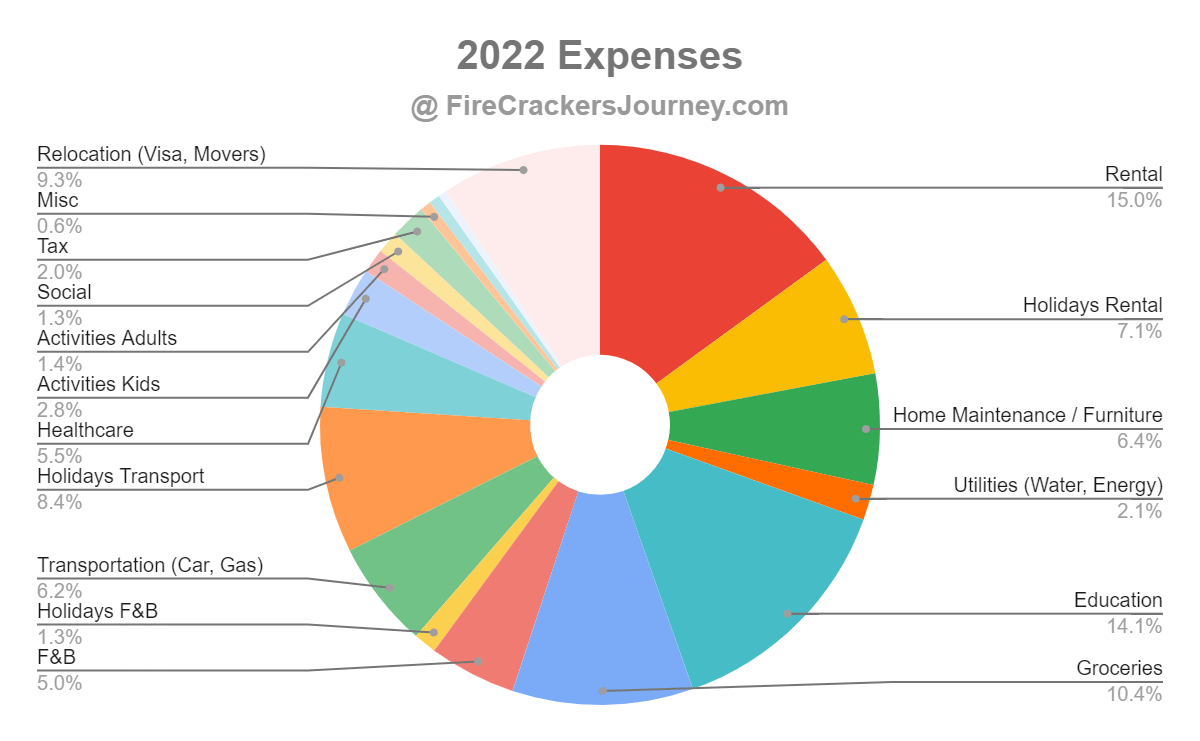

Although we faced inflation and moved to a high cost of living place in 2022, we managed to keep our expenses in check. Dedication to constantly track our expenses and search for best alternative were critical to enjoy the year without tightening our belts. While our withdrawals have naturally increased, they still remain in the safe zone.

Like this:

Like Loading...

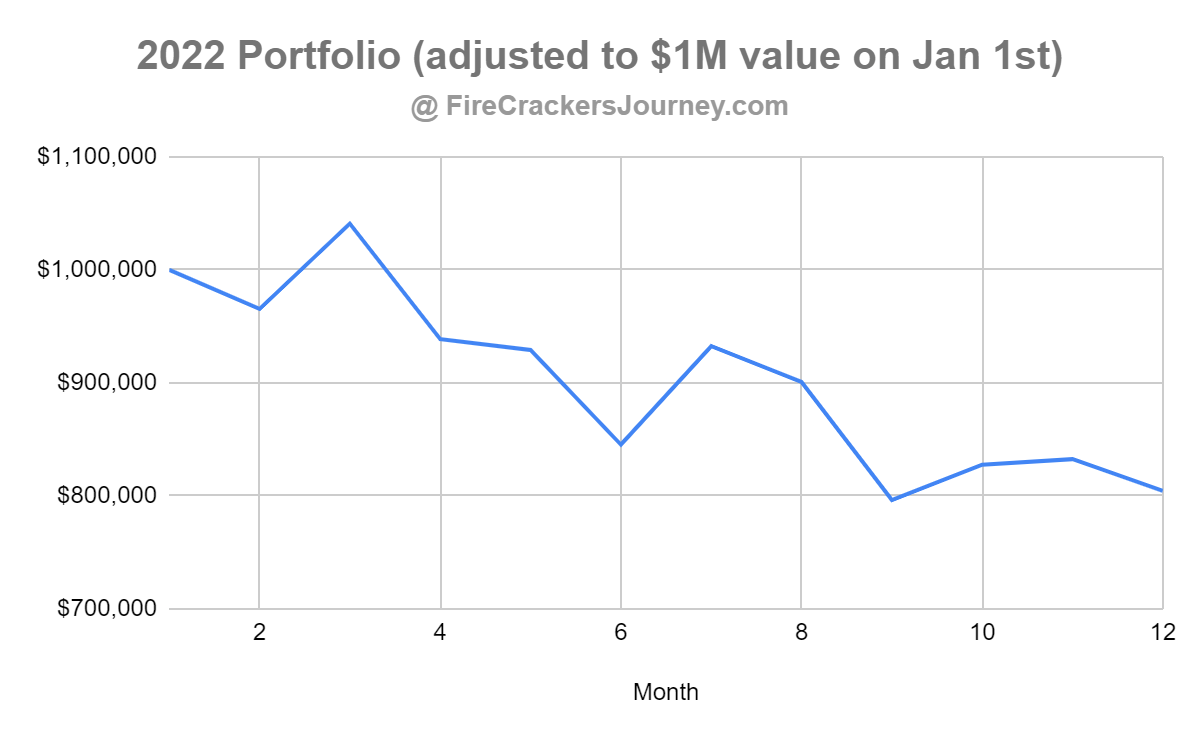

2022 has been a roller coaster year for our portfolio and expenses. Nevertheless, we managed to stay calm although an impressive drop along the year. As we learned a few years back, the best thing to do is actually nothing, and let the storm pass. It is thus important to design a plan in less turbulent times, and stick to it when facing some headwinds.

Like this:

Like Loading...

假设你已经在财务自由的课题上花了不少的时间研究,心里决定了你十年之内就要退休,然后周游世界,享受人生。那么下一步应该是什么呢?

Like this:

Like Loading...

You are considering Dubai in your FIRE plan because it has no tax. Indeed, Dubai is very attractive with nice hot weather and no personal income tax. However, you will experience hidden fees everywhere which do really add up. Stay vigilant.

Like this:

Like Loading...

从小到大,自己成长的理念跟社会的期望很相似:努力读书,拿到好成绩,到社会做事,为自己和未来的家庭打拼。小时候,我读的是香港的传统地区学校,校风不俗,但都不是什么名校。大学毕业后到银行工作,直到在外国完成工商管理硕士,再在投行和商行工作,收入不俗,但总觉得欠缺了一点人生意义。心理反覆地想着,难道人生就是这样的一个向上爬、跟同辈比较的无限循环?

Like this:

Like Loading...

You are experiencing the “One More Year Syndrome” (OMYS), because your FIRE plan isn’t bulletproof yet. You might need to review your plan and/or your finances so that you feel comfortable to finally claim that you are Financially Independent.

Like this:

Like Loading...

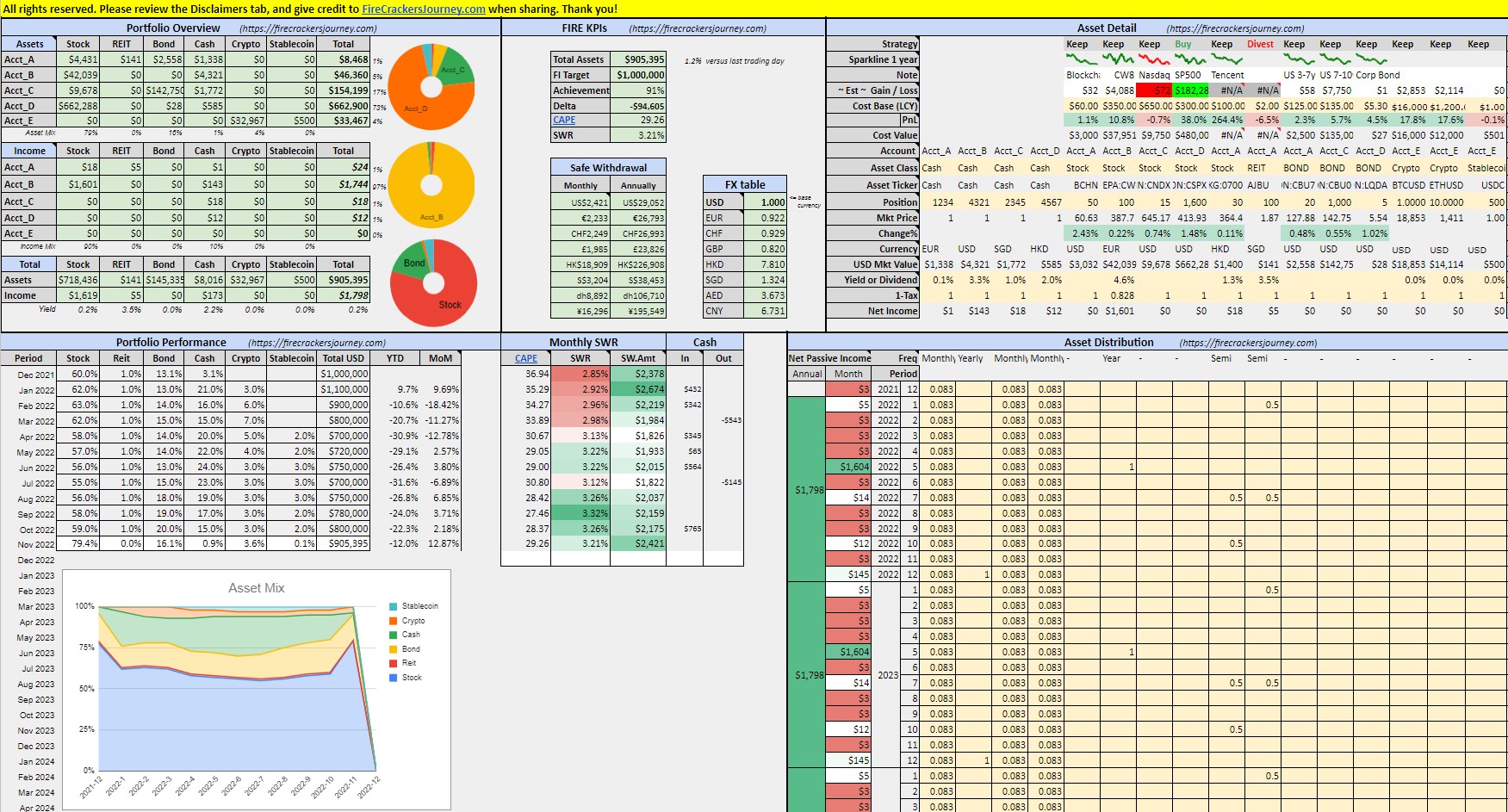

Build a consolidated view of all your assets (multi-currency and multi-location) in a single FIRE wealth management tool for FREE, and estimate your monthly Safe Withdrawal amounts based on CAPE ratio.

Like this:

Like Loading...