Taxes can significantly impact your financial performance. Delaying taxes or strategically offsetting them with capital losses can greatly enhance your investment returns.

Like this:

Like Loading...

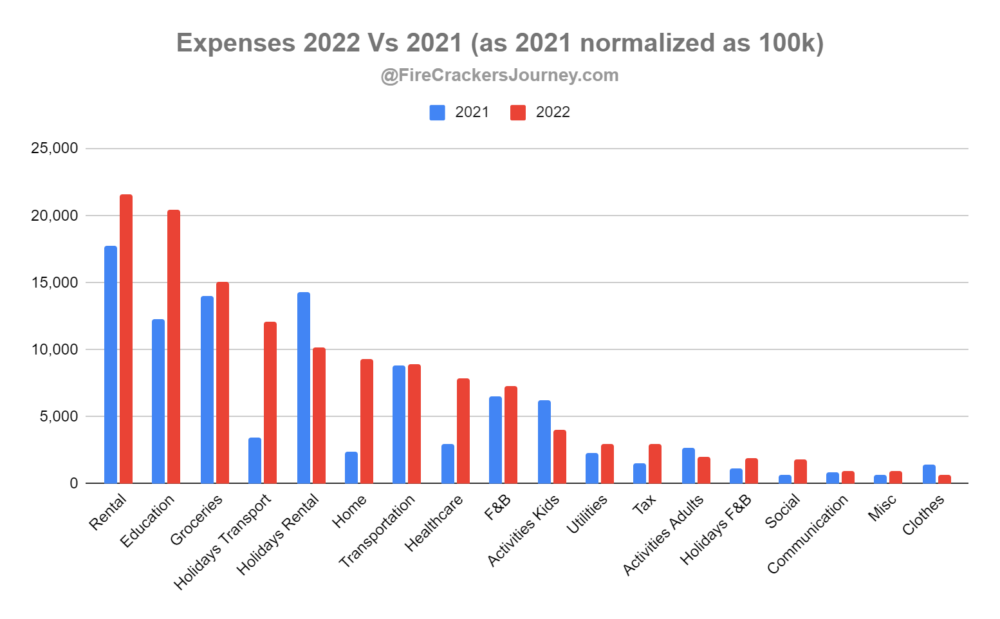

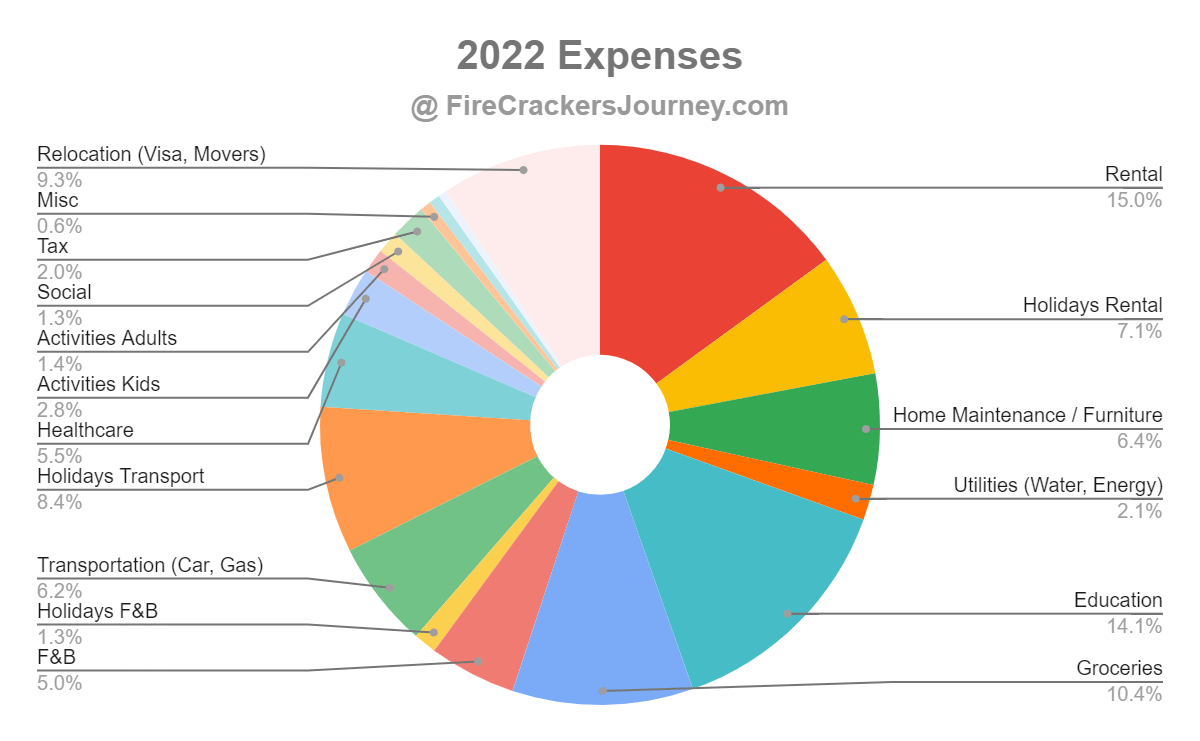

Moving to a new country is expensive. Moreover, inflation combined with a higher cost of living pushed our expenses beyond what we expected. We had to adjust our lifestyle and spending habits to keep our expenses within our budget.

Like this:

Like Loading...

Although we faced inflation and moved to a high cost of living place in 2022, we managed to keep our expenses in check. Dedication to constantly track our expenses and search for best alternative were critical to enjoy the year without tightening our belts. While our withdrawals have naturally increased, they still remain in the safe zone.

Like this:

Like Loading...

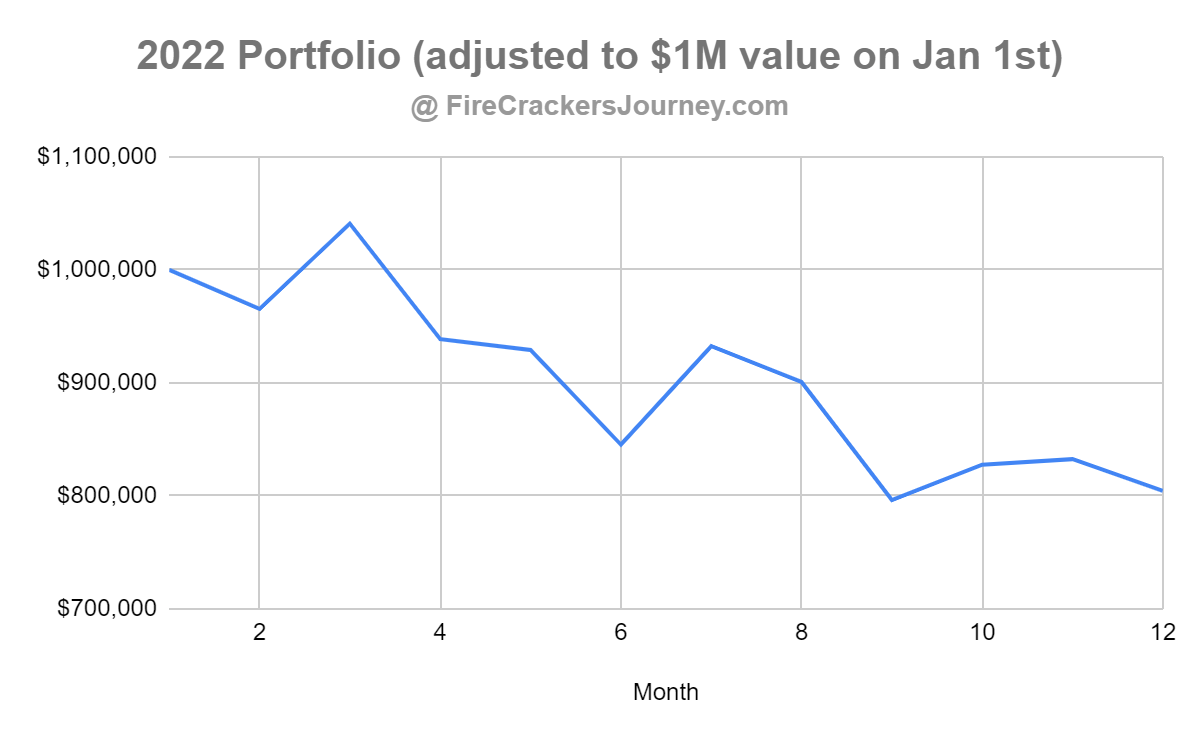

2022 has been a roller coaster year for our portfolio and expenses. Nevertheless, we managed to stay calm although an impressive drop along the year. As we learned a few years back, the best thing to do is actually nothing, and let the storm pass. It is thus important to design a plan in less turbulent times, and stick to it when facing some headwinds.

Like this:

Like Loading...

You are experiencing the “One More Year Syndrome” (OMYS), because your FIRE plan isn’t bulletproof yet. You might need to review your plan and/or your finances so that you feel comfortable to finally claim that you are Financially Independent.

Like this:

Like Loading...